Investors today demand real-time insights into startup performance, not just quarterly updates. Here are the 7 key KPIs they monitor to make fast, informed decisions:

- Revenue Growth Rate: Tracks how quickly a company is scaling. For early-stage startups, 15-25% month-over-month (MoM) growth is a key target.

- Gross Margin: Measures operational efficiency. SaaS companies aim for 70–90%, while e-commerce businesses target 40–60%.

- Burn Rate: Monitors how fast cash reserves are depleting. This is critical for managing expenses and projecting cash runway.

- Customer Acquisition Cost (CAC): Evaluates the cost of acquiring each customer. Lower CAC indicates more efficient growth.

- Customer Lifetime Value (LTV): Estimates the total revenue from a single customer, helping to assess long-term profitability.

- Monthly/Annual Recurring Revenue (MRR/ARR): Tracks consistent subscription income, crucial for forecasting and growth planning.

- Cash Runway: Shows how long a company can operate before running out of cash, based on current expenses and revenue.

Why this matters: Real-time KPI tracking allows startups to adjust strategies quickly, improve transparency, and build trust with investors. Tools like Lucid Financials simplify this process by automating data collection, integrating with accounting systems, and offering dynamic dashboards.

Quick Comparison Table:

| KPI | Purpose | Target/Benchmark |

|---|---|---|

| Revenue Growth Rate | Measures scalability | 15–25% MoM (early stage) |

| Gross Margin | Tracks operational efficiency | SaaS: 70–90%, E-commerce: 40–60% |

| Burn Rate | Monitors cash depletion | Maintain sustainable spending |

| Customer Acquisition Cost | Evaluates cost of acquiring customers | Lower than LTV |

| Customer Lifetime Value | Assesses long-term customer revenue | High relative to CAC |

| MRR/ARR | Tracks recurring subscription income | Stable or growing |

| Cash Runway | Projects operational sustainability | 12–18 months (ideal) |

Real-time KPI tracking is no longer optional - it’s essential for making smarter financial decisions and staying competitive.

KPIs for your investors | Founder Fridays - August 2022

What Are KPIs and Why They Matter

KPIs, or Key Performance Indicators, measure how effectively a company achieves its business goals. Real-time tracking of these metrics allows investors to monitor critical performance data instantly, rather than waiting for quarterly updates. This helps them make faster, well-informed decisions.

Here’s how KPIs play a role in financial oversight, assessing growth, and improving communication with stakeholders:

- Financial Health Assessment Real-time KPIs offer a clear picture of a company’s financial stability. By continuously tracking metrics like burn rate and cash runway, businesses can quickly address resource management challenges when they arise.

- Growth Potential Evaluation KPI tools allow investors to compare a startup’s performance against industry standards, such as customer acquisition cost (CAC). This helps determine how the company stacks up against competitors.

- Stakeholder Communication Clear and consistent KPIs simplify discussions with board members and investors. Transparent metrics support better financial planning and fundraising strategies.

"Create investor and board reports instantly to effectively communicate with shareholders."

- Lucid Financials

Keeping metrics current helps startups:

- Make informed decisions about resource allocation

- Spot and address performance issues early

- Build trust with investors through transparent reporting

- Analyze scenarios to refine strategies

Real-time KPI tracking changes how startups and investors work together. The steady flow of actionable data not only boosts investor confidence but also helps startups stay flexible and responsive to market demands.

Modern tools that offer instant access to KPI data are now essential for startups. These tools enable companies to create detailed financial reports, track performance, and maintain clear communication with stakeholders. For investors, this means having the insights they need to make confident decisions.

1. Revenue Growth Rate

What It Means and Why It Matters

Revenue Growth Rate measures how much a company's revenue increases over a specific period, such as month-over-month (MoM) or year-over-year (YoY). Investors use this metric to assess how scalable and appealing a business is. For early-stage startups, hitting at least 10% MoM growth is often necessary to catch the attention of venture capitalists.

For SaaS companies, a YoY growth target of 20% is common, while e-commerce businesses might aim for over 30% to offset typically lower profit margins.

How to Track It in Real Time

Modern financial tools make it easier to track revenue growth in real time by pulling data from accounting platforms, CRM systems, and payment tools. For example, Lucid Financials integrates with accounting software to deliver instant insights into revenue trends. This allows businesses to quickly identify changes, like a drop from 12% to 5% MoM growth, and make timely adjustments.

| Growth Stage | Tracking Frequency | Target Growth Rate |

|---|---|---|

| Seed/Early | Weekly | 15-25% MoM |

| Series A | Monthly | 10-15% MoM |

| Growth/Scale | Quarterly | 30-45% YoY |

How It Shapes Financial Planning

Tracking revenue growth in real time helps businesses make smarter decisions. For instance, maintaining a 15% MoM growth rate might justify hiring more employees, while a decline could signal the need to cut costs.

To analyze growth accurately, avoid these common mistakes:

- Confusing seasonal spikes with sustainable growth

- Including deferred revenue incorrectly

- Ignoring customer churn

For precise tracking:

- Break down revenue streams and follow GAAP standards

- Use a simple formula for weekly growth:

((Current Week - Previous Week) / Previous Week) × 100

A great example of the importance of proper tracking comes from Nasty Gal. Between 2011 and 2012, the company grew its annual revenue from $28 million to $100 million by closely monitoring growth metrics and adapting strategies in real time.

2. Gross Margin

Definition and Relevance to Investors

Gross margin, calculated as (Revenue - COGS) / Revenue × 100, measures how efficiently a business operates and scales. It reflects the portion of revenue left after covering direct production costs, offering insights into the company’s financial health and cost management.

Different industries have varying gross margin benchmarks:

| Industry | Target Margin Range |

|---|---|

| SaaS/Technology | 70–90% |

| E-commerce | 40–60% |

| Manufacturing | 20–30% |

Today, real-time tracking tools allow businesses to manage margins more effectively.

Real-time Tracking Methods

Modern tools like Lucid Financials integrate with accounting software and bank feeds to provide instant updates on gross margin changes. This helps businesses quickly spot cost issues and address them before they hurt profitability.

Key ways to track gross margins include:

- Categorizing direct production costs accurately

- Regularly reviewing supplier pricing

- Automating data synchronization

- Monitoring margin trends on a daily basis

Impact on Financial Planning and Decision-making

Access to real-time margin data allows businesses to make quick adjustments. For example, a U.S. hardware startup saw its gross margin drop from 55% to 45% over three months. By analyzing detailed cost data, they identified inefficiencies, switched suppliers, and recovered to 52% within just two months. Similarly, a SaaS company improved its Q2 gross margin from 78% to 82% by optimizing AWS expenses.

Strong gross margins can also enhance fundraising opportunities. A 2024 Crunchbase report found that startups improving their margins by 20% or more achieved Series A valuations about 35% higher than their competitors.

To stay on top of margins, businesses should monitor daily fluctuations, set monthly targets that align with industry norms, review COGS weekly, and maintain detailed cost breakdowns. Companies using automated tracking tools have seen results - 41% reported margin increases of 5% or more within their first six months of implementation.

3. Burn Rate

Monitoring burn rate in real time, just like revenue growth and gross margin, gives businesses actionable data for smarter financial management.

What Is Burn Rate and Why Does It Matter?

Burn rate measures how fast a company uses its cash reserves. For investors, it’s a key indicator of a company's ability to sustain operations and manage finances efficiently. This is especially important for startups that haven’t reached profitability.

Burn rate comes in two forms:

| Type | Definition | What It Reveals |

|---|---|---|

| Gross Burn | Total monthly operating expenses | Overall spending rate |

| Net Burn | Monthly cash loss (expenses minus revenue) | Actual rate of cash depletion |

How to Track Burn Rate in Real Time

Modern financial platforms make burn rate tracking easier by automating data collection and analysis. These tools often integrate with systems like QuickBooks, payroll platforms, and bank accounts, offering instant insights into spending patterns.

Features like daily cash flow monitoring, real-time expense categorization, automated alerts, and variance analysis provide a full picture of burn rate. These tools help businesses align their spending with their broader financial goals.

Why Real-Time Burn Rate Monitoring Matters

Keeping a close eye on burn rate empowers businesses to make faster, smarter financial decisions. Erez Lugashi, CEO of Abilisense, shares his experience:

"Keeping track of my finances used to be overwhelming, but now it's much simpler. The platform is well-organized and easy to navigate"

Here’s how real-time tracking impacts financial planning:

- Spotting unsustainable spending early

- Accurately projecting cash runway for better fundraising timing

- Cutting costs strategically without stalling growth

- Making immediate spending adjustments when needed

- Providing clear financial outlooks for stakeholders

- Planning fundraising efforts with data-backed timelines

Aviv Farhi, Founder and CEO of Showcase, highlights the benefits:

"Lucid has made it incredibly easy to track spending, plan ahead, and handle our growth. It's straightforward and effective"

4. Customer Acquisition Cost (CAC)

What Is CAC and Why Does It Matter?

Customer Acquisition Cost (CAC) measures how much a company spends to gain a new customer. It’s a key indicator of how efficiently a business is managing its marketing and sales efforts. To calculate CAC, use these formulas:

- Total CAC: Marketing & Sales Expenses ÷ New Customers

- Marketing CAC: Marketing Expenses ÷ Marketing-Generated Customers

- Sales CAC: Sales Expenses ÷ Sales-Generated Customers

This metric helps assess whether growth efforts are cost-effective and sustainable, which is critical for both businesses and investors.

How to Track CAC

Modern tools make tracking CAC easier by pulling data from multiple sources in real-time. Platforms like Lucid Financials provide dashboards that combine marketing, sales, and acquisition data, offering a clear view of cost efficiency.

Here are some essential components of CAC tracking:

| Component | Purpose |

|---|---|

| Channel Attribution | Helps allocate marketing budgets effectively |

| Expense Categorization | Ensures accurate tracking of costs |

| Customer Journey Analysis | Identifies the most efficient ways to acquire customers |

These elements work together to highlight inefficiencies and guide businesses toward better spending decisions.

Why CAC Matters for Financial Planning

Real-time CAC tracking plays a crucial role in financial planning. It allows businesses to quickly identify inefficiencies and make adjustments. Comparing CAC against industry standards can reveal whether spending is aligned with expected returns.

Monitoring CAC supports:

- Quick shifts in strategy when needed

- Improved resource allocation

- Accurate forecasting for growth

- Smarter investment decisions

If CAC rises without a matching increase in customer lifetime value, it could indicate a problem with the business model. Keeping a close eye on trends helps businesses adapt their spending strategies before small issues become big problems.

sbb-itb-17e8ec9

5. Customer Lifetime Value (LTV)

What Is Customer Lifetime Value?

Customer Lifetime Value (LTV) estimates the total revenue a business can expect from a single customer throughout their relationship. It’s a key metric for understanding long-term profitability and the strength of customer relationships. When tracked in real time, LTV works alongside metrics like Customer Acquisition Cost (CAC) to fine-tune marketing and growth strategies.

A solid LTV often reflects:

- Frequent repeat purchases

- Upgrades to higher-tier products or services

- Long-term subscriptions

- Consistent revenue streams

How to Track LTV in Real Time

Modern financial tools make it easier to track LTV by analyzing multiple data points. Here’s a quick breakdown:

| Data Component | Purpose |

|---|---|

| Purchase History | Tracks spending habits and frequency |

| Subscription Duration | Measures how long customers stick around |

| Service Usage | Assesses engagement and value derived |

| Upgrade Rates | Highlights opportunities for growth |

Platforms like Lucid Financials streamline this process by integrating data from various sources, providing instant insights into customer value.

Why LTV Matters for Financial Decisions

Real-time LTV tracking isn’t just about monitoring customer value - it’s a critical tool for making informed financial decisions. Like CAC, LTV helps businesses align their spending with long-term profitability. Here’s how companies use LTV data:

- Smarter Marketing Investments: Adjust campaigns to attract high-value customers.

- Better Product Development: Prioritize features that boost retention and engagement.

- Effective Pricing Strategies: Set prices that maximize revenue over time.

To get the most out of LTV, businesses should pair it with other metrics:

| Metric Combination | Why It’s Useful |

|---|---|

| LTV:CAC Ratio | Evaluates how cost-effectively customers are acquired |

| LTV by Segment | Pinpoints which customer groups are most profitable |

| LTV Growth Rate | Tracks improvements in customer value over time |

| LTV by Channel | Identifies the most lucrative acquisition sources |

6. Monthly and Annual Recurring Revenue

Definition and Importance to Investors

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) are key indicators of a company's steady income from subscriptions. These metrics are especially crucial for subscription-based businesses, as they provide a clear view of consistent revenue and financial health. MRR reflects the monthly revenue from active subscriptions, while ARR gives the yearly perspective (e.g., $1,200 annually equals $100 MRR). These metrics simplify revenue tracking and support effective planning.

| Type | Calculation Method | Best Use Case |

|---|---|---|

| MRR | Monthly subscription value + add-ons | Analyzing short-term trends |

| ARR | MRR × 12 or annual subscription value | Long-term forecasting and reports |

| Expansion MRR | Revenue from upgrades and add-ons | Measuring growth |

Tools for Real-Time Tracking

Modern financial tools make it easy to track MRR and ARR in real time by integrating with your data systems. This allows businesses to respond quickly to changes and make informed decisions.

- Revenue Recognition: Automatically calculates revenue based on subscription terms.

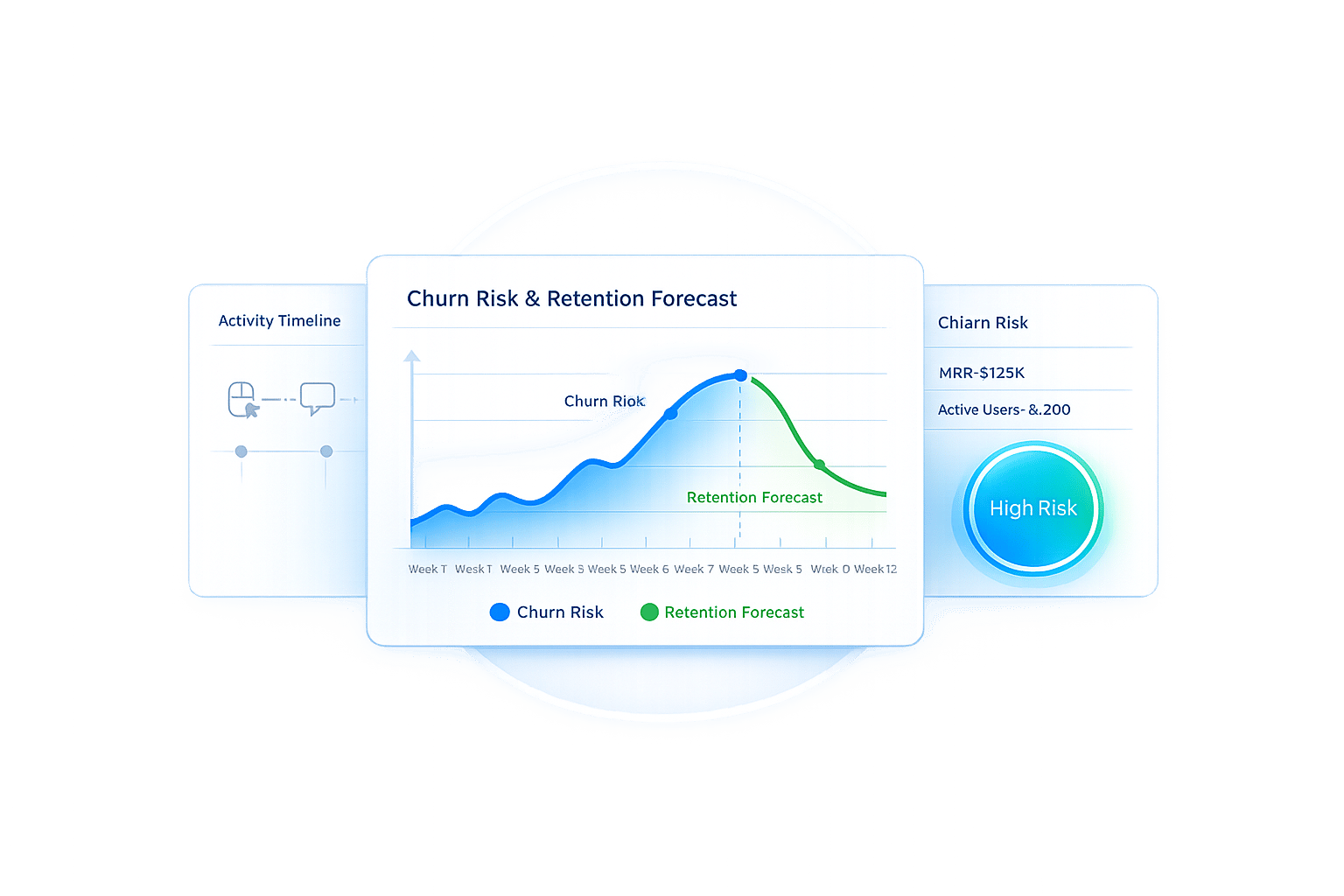

- Churn Monitoring: Tracks customer cancellations and their financial impact.

- Expansion Tracking: Instantly updates revenue from upgrades and additional services.

Role in Financial Planning and Decision-Making

Having instant access to MRR and ARR data can enhance financial planning in several ways:

| Activity | Advantage |

|---|---|

| Scenario Planning | Compare potential growth paths instantly. |

| Investor Updates | Provide up-to-date revenue reports. |

| Growth Strategy | Spot trends and opportunities to improve. |

| Cash Management | Make smarter spending and investment choices. |

When combined with other financial metrics, tracking MRR and ARR provides a complete picture of a company's financial health. Platforms like Lucid Financials make this process easier by automating calculations and offering instant insights for better decision-making.

7. Cash Runway

Beyond metrics like CAC and recurring revenue, cash runway provides a clear picture of a startup's ability to sustain operations in the near term.

What Is Cash Runway and Why It Matters?

Cash runway is the amount of time a company can operate before depleting its cash reserves, assuming expenses and revenues remain steady. For investors, this metric is a key indicator of a company's financial health and helps guide decisions on how to ensure the business stays operational.

How to Track Cash Runway in Real-Time

Modern financial tools can track cash runway in real time by analyzing burn rate and cash flow. These platforms pull daily data, giving businesses up-to-date insights that allow them to adjust spending and plan for future needs effectively.

Why Real-Time Tracking Matters for Financial Decisions

Having real-time visibility into cash runway helps businesses make smarter financial decisions. Tools like Lucid Financials provide features such as automated scenario planning, burn rate analysis, and dynamic forecasting. According to Lucid Financials:

"Get real-time insights into your burn rate and runway, helping you make informed financial decisions to extend your runway and sustain your growth."

This kind of insight supports better cost management, smarter fundraising, and stronger financial planning - all of which help maintain a solid financial position that investors value.

Tools for KPI Tracking and Display

Keeping track of financial KPIs in real time is essential for modern financial management. The right tools can make this process smooth and efficient. Lucid Financials offers a platform that automates KPI tracking with integrations and AI-driven analytics.

Automated Data Collection and Integration

Lucid Financials connects directly with tools like QuickBooks, payroll systems, and banking platforms. This eliminates the need for manual data entry and ensures your KPIs stay current. Here's how these integrations work:

| Integration Type | Key Benefits | Real-Time Capabilities |

|---|---|---|

| QuickBooks | Syncs financial data | Tracks revenue and expenses |

| Payroll Systems | Monitors employee costs | Calculates burn rates |

| Banking | Tracks cash flow | Projects cash runway |

| Industry Benchmarks | Compares performance to peers | Provides market metrics |

Customizable Dashboards

Lucid Financials allows financial teams to create dashboards tailored to their needs. These dashboards can display critical investor KPIs, such as:

- Revenue growth trends

- Gross margin breakdowns

- Current burn rate

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (LTV)

- Monthly and Annual Recurring Revenue (MRR/ARR)

- Cash runway forecasts

For deeper insights, the platform also includes advanced reporting tools.

Smart Reporting Features

The reporting system is designed to save time and simplify financial management. These reports provide actionable insights to help guide strategic decisions without the hassle of manual analysis.

Industry Benchmarking

Lucid Financials also offers industry-specific benchmarks. This feature lets businesses compare their KPIs with those of industry peers. It can even highlight areas where your metrics differ significantly from the competition, giving you a clearer picture of where improvements may be needed.

Real-Time Scenario Planning

The platform makes scenario planning straightforward. You can model various financial scenarios and see their impact on key metrics instantly, helping you make informed decisions quickly and efficiently.

How to Track and Report KPIs to Investors

A well-structured KPI reporting system boosts transparency and supports quick, informed decisions that align with investor expectations.

Setting Up Your KPI Dashboard

Create a real-time dashboard that highlights your key metrics. Organize the data to showcase your company's growth, using dashboards that update automatically as new information comes in.

Standardizing Your Reporting Process

Stick to a regular reporting schedule and format that aligns with what investors expect.

| Reporting Frequency | Best For | Key Components |

|---|---|---|

| Monthly | Early-stage startups | Cash position, burn rate, runway |

| Quarterly | Growth-stage companies | Detailed financial statements, KPI trends |

| Annual | All companies | Comprehensive financial review, strategic plans |

Consistently verify the data to maintain trust and reliability.

Ensuring Data Accuracy

Follow these steps to keep your data reliable:

- Data Collection: Use direct integrations to gather accurate information.

- Validation Process: Set up a review system to cross-check financial data before sharing it with investors.

- Documentation: Keep detailed records of how calculations were made and the sources used. This builds credibility and supports audits.

Creating Effective Investor Reports

Investor reports should be clear and easy to understand while still providing enough detail. A streamlined format ensures transparency and saves time for everyone involved.

Scenario Planning for Investor Discussions

Prepare for investor conversations by including best-case, worst-case, and baseline scenarios. This shows you're ready for different outcomes and have considered potential risks.

Leveraging Industry Benchmarks

Add industry benchmarks to your reports to give investors context for your KPIs. This helps them assess your performance compared to others in your market.

Automating the Process

Use AI-powered tools to automate your KPI reporting. This reduces errors and ensures your reports comply with US financial standards, while also maintaining the real-time transparency mentioned earlier.

Conclusion

Tracking KPIs in real time helps startups stay on top of their growth, manage finances effectively, and meet investor expectations. These insights empower teams to make quick, informed decisions that strengthen investor confidence.

By centralizing key metrics on a single platform, startups can align their operations with what investors care about most. Aviv Farhi from Showcase highlights how the platform simplifies financial management and future planning.

Lucid Financials' AI-powered platform speeds up financial analysis - up to 100 times faster. It allows startups to create detailed financial plans, compare against industry benchmarks, generate investor reports instantly, and monitor critical KPIs - all in real time.

This tool reshapes the way startups handle metrics and reporting, offering the transparency and data-driven approach needed to build trust with investors and drive growth.

FAQs

What advantages do real-time KPIs offer compared to traditional quarterly reports for investors?

Real-time KPIs provide investors with up-to-the-minute insights into a company's performance, allowing them to make faster, more informed decisions. Unlike traditional quarterly reports, which offer a retrospective view, real-time data enables proactive responses to trends and challenges as they happen.

By tracking metrics like revenue growth, burn rate, and customer acquisition costs in real time, investors can identify opportunities and risks earlier. This dynamic approach ensures greater transparency and fosters stronger trust between startups and their investors.

How can I ensure data accuracy when tracking KPIs in real time?

To ensure data accuracy while tracking KPIs in real time, start by integrating reliable data sources like accounting software, payroll systems, and banking tools to minimize manual errors. Use automated tools that sync your financial and operational data in real time to avoid discrepancies. Regularly review and validate your data to ensure it aligns with your business goals and reporting standards.

Additionally, establish clear processes for data entry and updates, and ensure your team is trained on best practices. Platforms like Lucid Financials can help streamline this by providing real-time insights and automating financial tracking, allowing you to focus on strategic decision-making with confidence in your data.

What are the best ways for startups to share KPI trends and insights with investors to build trust and confidence?

Startups can build trust and confidence with investors by sharing clear, consistent, and actionable insights about their KPIs. Start with regular updates - monthly or quarterly reports work well - highlighting key metrics like revenue growth, customer acquisition cost (CAC), or burn rate. Use visual tools like charts or graphs to make trends easy to understand.

Be transparent about challenges and how you're addressing them. Investors value honesty as much as success. Tools like real-time dashboards can also help by providing up-to-date insights, showing that you're actively managing your business. Platforms like Lucid Financials can simplify this process by offering real-time financial tracking and customizable reports tailored for investor communication.