Want to make financial data easier to understand and act on? These 7 principles will help you turn complex numbers into clear, actionable stories that drive decisions:

- Keep It Clear and Simple: Avoid overwhelming your audience. Use rounded numbers, prioritize key points, and tailor your message to your audience's needs.

- Understand Your Audience: Different stakeholders care about different data. Customize your presentation to focus on what matters most to them.

- Use the Right Visuals: Choose visuals like line charts or bar graphs that match your data type. Highlight trends and key points with clean, clear designs.

- Add Context and Comparisons: Numbers alone aren't enough - compare them to past performance, industry benchmarks, or strategic goals to provide meaning.

- Highlight Key Metrics: Focus on core metrics like revenue growth or profit margins. Avoid information overload by sticking to the most relevant data.

- Organize Data in a Logical Order: Present data in a sequence that flows naturally - start with context, explain trends, and end with actionable insights.

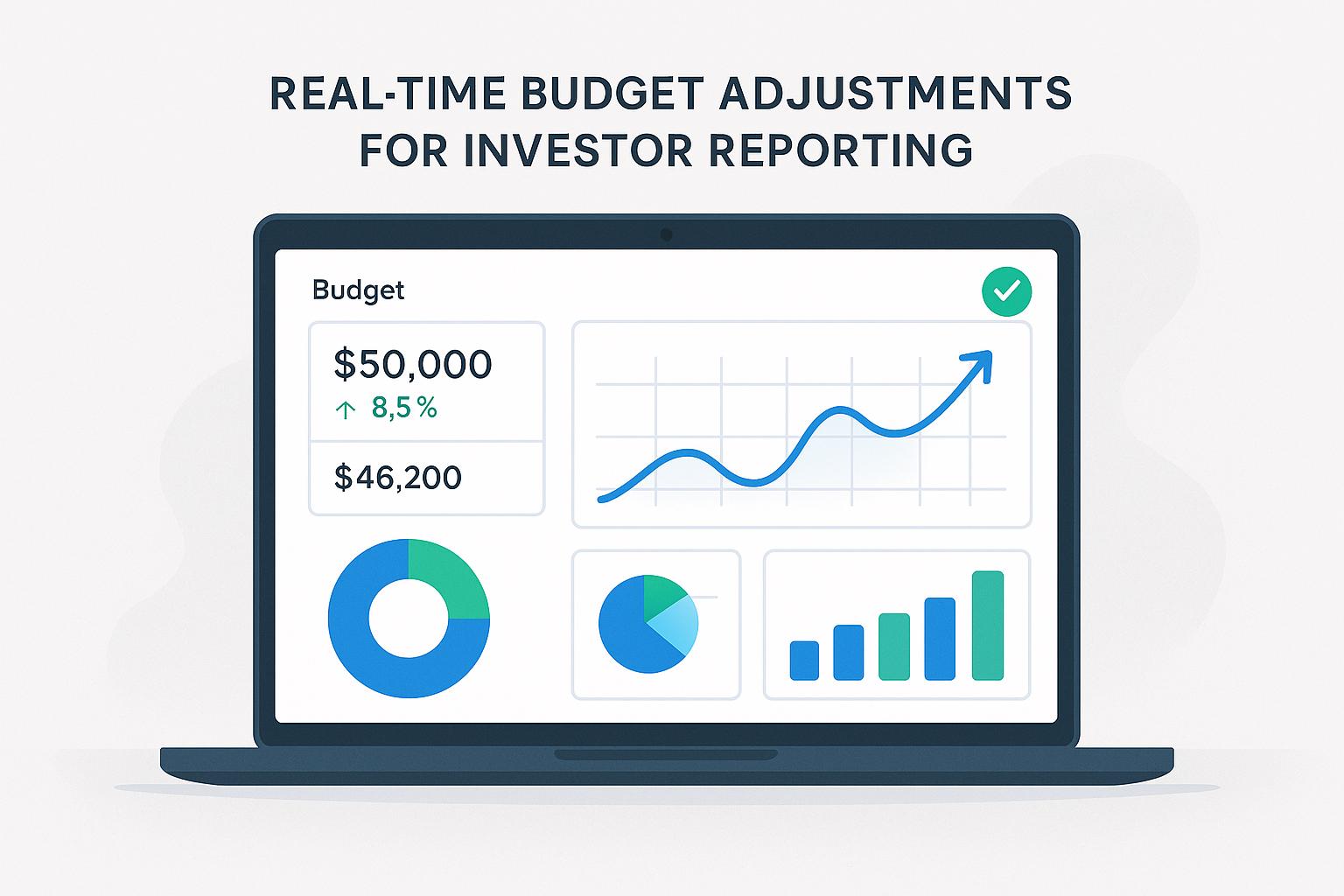

- Use Interactive Tools: Leverage real-time dashboards and interactive visuals to make your data dynamic, engaging, and easier to explore.

Quick Tip: Tools like Lucid Financials can simplify this process by automating data visualization, providing real-time insights, and tailoring dashboards for different audiences.

Telling a Story with Data

1. Keep It Clear and Simple

When it comes to presenting financial data, clarity is everything. Complex figures can easily overwhelm and confuse your audience. Research shows that decision-makers are more likely to take action when data is presented in a straightforward, easy-to-understand way, rather than buried in jargon or overly detailed reports.

The trick to simplifying financial data is to present it clearly while keeping it accurate. For instance, instead of showing $1,247,892.37, round it to $1.25M to convey the key point without unnecessary detail.

"When a presentation is effective, it serves as a bridge, simplifying complex financial concepts into digestible information that fosters clarity and understanding among diverse audiences." - Financial Analysts Association

Here’s how to make your financial storytelling clear and impactful:

Prioritize Visual Hierarchy

- Highlight the most important numbers first.

- Arrange supporting details in order of relevance.

- Use consistent formatting for similar data types to avoid confusion.

Simplify Calculations

Instead of diving into every formula, share the final results with a concise explanation. For example, when discussing profitability, focus on the margin percentage and the major factors influencing it, rather than walking through every calculation step.

Tools like Lucid Financials can help streamline this process by integrating directly with accounting systems, ensuring your data is both clear and accurate.

Different stakeholders need different levels of detail, so tailoring your presentation is key. Here’s an example of how to approach this:

| Stakeholder Group | Preferred Level of Detail | Key Focus Areas |

|---|---|---|

| Board of Directors | High-level quarterly summaries | Balance sheet, income statement, cash flow |

| Senior Management | Detailed monthly reports | Financial models, forecasting, trends |

| Department Heads | Specific departmental metrics | Budget vs. actual, KPIs |

Simplifying doesn’t mean dumbing things down. The goal is to make financial data easy to grasp while maintaining its accuracy and depth. Use standard industry terms when necessary, but always provide explanations for technical jargon that might not be familiar to everyone.

Once you’ve nailed clarity, the next step is understanding your audience to make your financial storytelling even more effective.

2. Understand Your Audience

To share a financial story effectively, you need to know who you're speaking to and what matters most to them. Different stakeholders care about different aspects of financial data, so tailoring your approach is key.

What Do Your Stakeholders Care About?

Each group has its own focus and priorities:

- Investors: They're interested in growth potential, ROI, and market performance.

- Executives: They look for insights into strategic planning, operational efficiency, and forecasts.

- Team Members: They want to understand how financial outcomes affect their department and performance metrics.

"Data visualization storytelling is not just about presenting financial data – it's about crafting a compelling narrative that resonates with your audience." - Finance Alliance [3]

How to Tailor Your Communication

Think about your audience's familiarity with financial concepts and what they need from the data. For example, investors may want in-depth growth projections, while team members are more concerned with metrics that impact their day-to-day tasks. Tools like Lucid Financials allow you to create custom dashboards that cater to these varying needs.

Tips for Effective Communication

- Adjust the level of technical detail to match your audience's expertise.

- Link the data directly to what your audience values most.

- Use formats that make it easy to grasp the key points quickly.

3. Use the Right Visuals

Visuals play a crucial role in financial storytelling, transforming numbers into clear, relatable narratives.

Choosing the Best Visuals for Your Data

Pick the right visual based on the type of data you're presenting and its purpose:

| Data Type | Best Visual Choice | When to Use |

|---|---|---|

| Time-series Data | Line Charts | Tracking revenue trends, growth patterns, or market performance |

| Categorical Comparisons | Bar Charts | Comparing department budgets, regional sales, or expense categories |

| Relationships | Scatter Plots | Showing cost vs. revenue correlations or performance metrics |

| Pattern Analysis | Heat Maps | Highlighting customer behavior trends or seasonal variations |

Tools like Lucid Financials can help by offering real-time, interactive dashboards that make financial data easier to understand.

Tips for Effective Financial Visuals

Make your visuals work harder for you by following these simple guidelines:

- Keep It Clean: Remove unnecessary details or clutter from your charts.

- Label Clearly: Use clear axis labels and data descriptions to avoid confusion.

- Be Consistent: Stick to a uniform color palette and font style to create a clear hierarchy.

- Highlight Key Points: Use bold colors or larger elements to draw attention to critical data.

Add Interactive Features

Interactive options like filtering, zooming, or hover-over tooltips allow stakeholders to explore data in more depth, making it easier for them to engage with and understand the information.

The ultimate goal is more than just presenting numbers - it's about making financial data clear, useful, and actionable. With the right visuals, you can turn complex numbers into stories that inform decisions and drive action. Next, we'll look at how providing context and comparisons can enhance your financial storytelling even further.

4. Add Context and Comparisons

Financial data becomes much more useful when paired with comparisons and context. On their own, raw numbers often leave out the bigger picture. Just like visuals make data easier to interpret, context and comparisons help tell the story behind those numbers.

Different types of context - like historical performance, industry averages, market trends, and strategic goals - help you see progress, compare with competitors, and measure results against expectations. Key methods include Year-over-Year (YoY) and Quarter-over-Quarter (QoQ) comparisons, industry benchmarks, and budget vs. actual analysis. These approaches give you a clearer view of performance.

Making Comparisons That Matter

When sharing financial data, use benchmarks that add clarity. For example, "Q4 revenue of $2.5M represents a 15% increase over the industry average, placing us in the top quartile among competitors."

Using Technology for Better Context

Tools like Lucid Financials make it easier to add context. They provide real-time benchmarks, letting you compare your metrics with industry peers to identify strengths and areas for growth.

Tips for Success

- Choose comparisons that align with your goals.

- Keep comparison periods consistent to avoid confusion.

- Consider external factors like market trends or industry shifts when analyzing data.

Once you've added the right context and comparisons, you're ready to focus on the metrics that matter most.

sbb-itb-17e8ec9

5. Highlight Key Metrics

When sharing your financial story, it's important to focus on the metrics that matter most. Too many numbers can confuse your audience and weaken your message. Instead, choose metrics that align with your business goals and what your stakeholders care about.

Choosing the Right Metrics

Stick to core metrics like revenue growth, profit margins, ROI, and cash flow. The key is understanding your audience. For example, investors are often more interested in growth potential and ROI, while operational managers might care more about profit margins and cash flow.

Making Metrics Stand Out

Show the connection between metrics and real business outcomes, like higher revenue or better efficiency. A dashboard approach can help organize these metrics clearly:

| Metric Category | Key Metrics to Highlight | Why It Matters |

|---|---|---|

| Growth | YoY Revenue Growth, Customer Acquisition | Reflects business expansion and market reach |

| Profitability | Gross Margin, Operating Margin | Demonstrates how efficiently the business operates |

| Efficiency | Cash Conversion Cycle, Working Capital | Shows financial health and operational stability |

Using Visuals Effectively

As mentioned earlier, visuals like line and bar charts can make trends and comparisons much clearer. They help emphasize what’s driving performance and make your data easier to digest.

"Financial storytelling is not just about presenting data; it's about crafting a compelling narrative that resonates with your audience." - Finance Alliance [3]

Leveraging Technology

Tools like Lucid Financials provide real-time dashboards that make it easier to track and present metrics dynamically. This ensures your data stays relevant and easy to understand.

Avoiding Common Mistakes

Keep your audience engaged by focusing on the most relevant metrics, providing context, and using simple, clear visuals. Remember, 70% of financial data fails to influence decisions because it’s poorly visualized or lacks a clear narrative [4].

6. Organize Data in a Logical Order

When presenting financial data, structuring it in a clear, logical sequence can make your story much easier to follow. A well-organized presentation helps stakeholders understand not just the numbers but the bigger picture behind them.

Start with Context and Build Connections

Kick things off with an executive summary to set the stage. Then, move into detailed financial data like income statements, balance sheets, and cash flow. Present these in a way that flows naturally, showing how different metrics connect. This approach allows you to explain why something happened - not just what happened. As Alan Black, former CFO of Zendesk, puts it:

"In the end, it's about being able to explain why something is happening, not just what happened. Because what happened is not super useful in and of itself" [1].

Follow a Timeline

Using a chronological order - past trends, current performance, and future projections - can make your narrative more intuitive. This progression helps stakeholders see how the financial story has evolved and where it’s heading.

Use Tools and Keep Visuals Consistent

Leverage tools like Lucid Financials to streamline data organization and compare scenarios instantly. Stick to consistent formatting, colors, and styles throughout your presentation to ensure clarity and professionalism.

"An effective financial data presentation not only conveys information but also tells a compelling story that helps the audience understand the financial health of the organization and its implications" [4].

Avoid Common Mistakes

Glenn Snyder, VP of FP&A at Zazzle, emphasizes the importance of tying financials to business drivers:

"You have to start with: what are the business drivers and how do they connect to the financials?… And that's where the heart of the story is" [2].

To keep your presentation effective, avoid these pitfalls:

- Dumping too much data on your audience at once

- Jumping between metrics without clear transitions

- Failing to maintain a cohesive narrative

Once your data is organized in a logical way, consider using interactive tools to make the experience more engaging and allow stakeholders to explore the story themselves.

7. Use Interactive Tools

By 2025, more than 70% of businesses are expected to use data visualization tools, highlighting their growing importance in financial reporting. Tools like Lucid Financials provide real-time views of trends, scenario comparisons, and industry benchmarks, giving stakeholders timely and actionable insights.

Real-Time Data and Dynamic Insights

Interactive dashboards let users dive into specific data points and analyze financial trends as they happen. Instead of static charts, these tools create dynamic, evolving stories that engage stakeholders and make the data easier to understand.

Tailored Views for Different Stakeholders

Interactive platforms can be customized for various audiences. Sergio Riojas, Chief Technology Officer at Grupo Multimedios, explains:

"Using Style Scope gave us the ability to provide a graphical representation of the key data to top management right out-of-the-box and move from static tables of numbers to charts and graphics that are much easier to understand" [3].

Tips for Using Interactive Tools

- Focus on the most relevant metrics.

- Ensure data is updated in real-time.

- Add annotations for context.

- Enable collaboration to share insights effectively.

Improving Decision-Making

These tools simplify complex data, turning it into insights that drive action. For board members or investors, interactive dashboards allow real-time scenario analysis and detailed exploration of metrics during discussions.

The global data visualization market is forecasted to hit USD 12.48 billion by 2028, growing at a CAGR of 11.6% from 2022 to 2028 [4].

Streamlining Reporting with Automation

Interactive platforms cut down on manual reporting, saving time and minimizing errors. They automatically update data and visualizations, freeing finance teams to focus on analysis and strategy instead of repetitive tasks.

Conclusion

Financial data storytelling has grown into a powerful way to communicate, moving beyond basic number crunching to influence decisions and foster engagement. The seven principles discussed here offer a solid foundation for creating financial narratives that connect with stakeholders effectively.

By using these principles, organizations can deliver focused, easy-to-understand financial messages, especially during board meetings or investor presentations. Research from Finance Alliance shows that companies adopting these methods experience noticeable improvements in engagement and decision-making efficiency [3].

Technology is playing a big role in transforming how financial stories are shared. Tools powered by AI, like Lucid Financials, are making storytelling easier by automating data analysis, offering real-time insights, and enabling quick scenario comparisons.

As these principles evolve, the role of AI and interactive tools in financial communication will only grow. The data visualization market is expected to reach USD 12.48 billion by 2028 [4], underlining the increasing need for tools that simplify complex data and enhance storytelling.

Shifting from static reports to dynamic storytelling is proving to be a game-changer. By applying these principles and embracing modern tools, organizations can craft financial narratives that drive better decisions and stronger business results.

FAQs

How to tell a story with financials?

Telling a story with financial data means blending numbers with context to create a narrative that resonates. Here's how to do it effectively:

1. Know Your Audience

Understand who you're speaking to - executives, investors, or non-finance professionals. Research from Finance Alliance shows that tailoring presentations to specific audiences boosts engagement by 40% [3].

2. Organize Your Message

Start with a clear takeaway, then back it up with the right data. For instance, if you're discussing revenue growth, combine trend analysis with insights into market conditions and the strategies that contributed to the results.

3. Make It Visual

Choose visuals that best represent your data. Include benchmarks and additional context to make your points stronger. Focus on metrics that matter most to your audience. Tools like Lucid Financials can help by offering real-time benchmarks and scenario comparisons.

4. Use Technology Wisely

Data visualization tools can turn static numbers into interactive, dynamic presentations. These platforms simplify updates and provide real-time insights, making your financial story easier to understand and act on [1].