Non-compliance with AI regulations in FinTech can lead to fines, reputational damage, and lost trust. As of 2025, regulations like the EU’s Digital Operational Resilience Act (DORA) demand strict adherence to data privacy, algorithmic fairness, and system transparency. Here’s a quick breakdown of the key points:

- Top Risks: Data privacy violations, algorithmic bias, lack of transparency, and governance challenges.

- Core Compliance Areas:

- Data Privacy: Follow GDPR/CCPA rules with encryption and access controls.

- Fairness: Test for bias and document efforts to ensure fairness.

- Transparency: Use tools like SHAP for explainable AI.

- Governance: Continuously validate models and track compliance.

- Solutions: Implement strong data governance, ethical AI guidelines, and automated compliance monitoring tools.

Startups must balance innovation with compliance by using AI tools for real-time monitoring, predictive risk assessment, and automated reporting. Collaboration between tech and compliance teams is essential to scale responsibly while meeting regulatory demands.

Understanding AI Compliance Risks

Defining AI Compliance Risks

With the EU's DORA requirements as a backdrop, AI compliance risks refer to the legal and operational challenges tied to automated decision-making in financial services. For startups managing sensitive data, these challenges are especially pressing.

The main hurdle is balancing regulatory requirements with the advantages AI offers. As financial technology advances, startups face a growing maze of rules related to data management, algorithm fairness, and system clarity.

Regulations Impacting AI in FinTech

AI-driven financial services must address three major regulatory areas:

- Data Privacy (GDPR/CCPA): Ensuring proper user consent and adhering to strict data management protocols.

- AI Governance: Validating models, testing for bias, and meeting audit requirements.

- Operational Resilience: Maintaining system reliability and meeting security standards.

These areas directly shape the risk management strategies discussed in Section 3.

Importance of AI Compliance for Startups

For startups, staying compliant with AI regulations is critical. Non-compliance can lead to hefty fines and long-term damage to operations and growth potential.

To meet compliance standards, AI systems must prioritize:

- Transparency: Clearly explain how decisions are made.

- Fairness: Prevent biased outcomes for different user groups.

- Security: Safeguard sensitive financial data.

- Accountability: Maintain detailed documentation of system development and deployment.

Startups that prioritize compliance weave it into their operations by setting up strong oversight processes to monitor regulatory updates and building comprehensive data governance frameworks [1]. These efforts lay the groundwork for the risk mitigation strategies outlined in Section 3.

AI Compliance Risks for FinTech Startups

Data Privacy and Security Risks

With the 2023 Schufa decision by the ECJ expanding GDPR's automated decision-making rules, FinTech startups face stricter requirements for handling financial data. Regulations like DORA now demand end-to-end encryption and strict access controls for AI systems managing sensitive information [2].

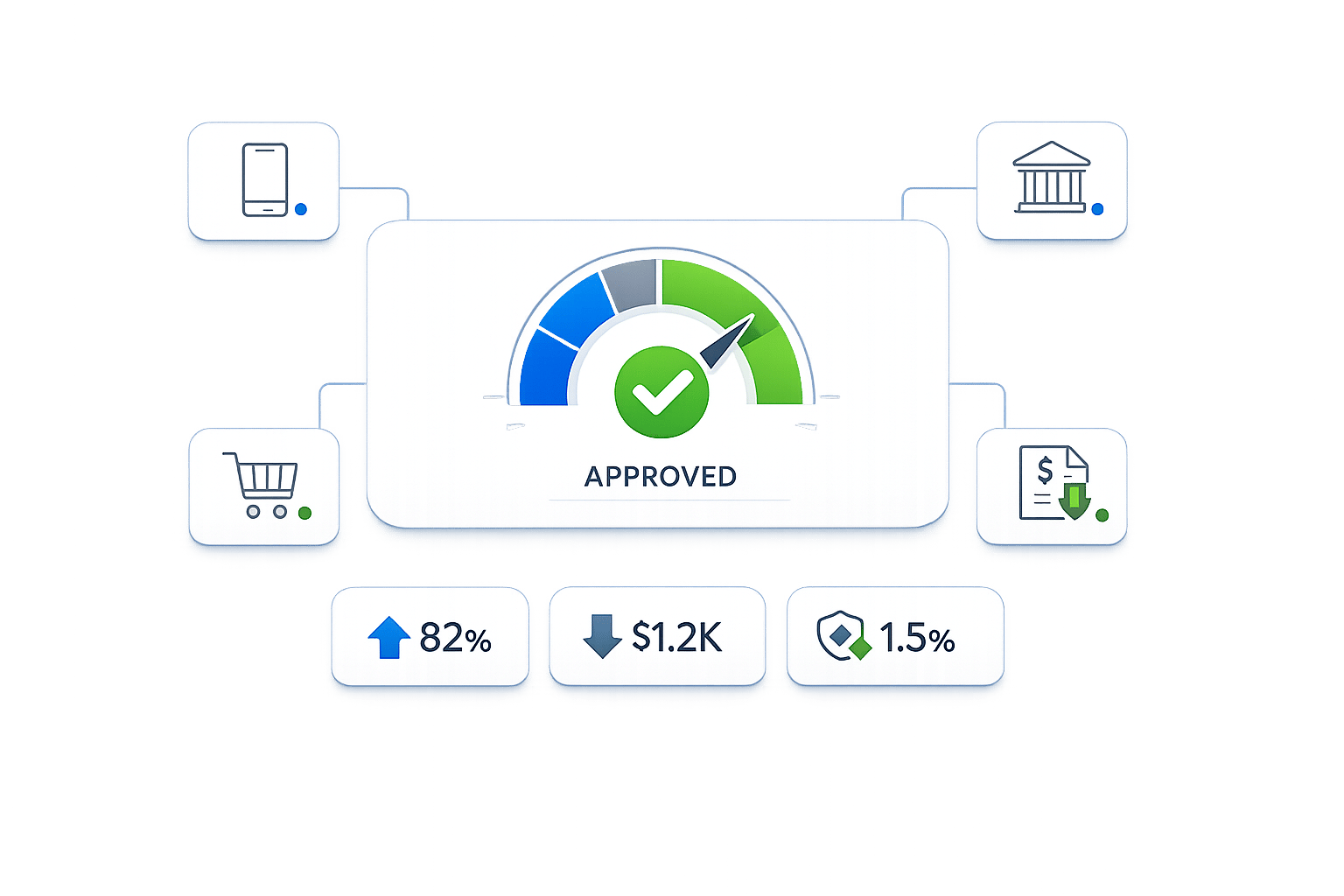

Algorithmic Bias Risks

AI decision-making in lending and credit scoring can unintentionally reflect biases present in historical data. For example, traditional credit scoring often disadvantages groups with limited credit history or unconventional financial habits. To address this, startups are expected to:

- Use diverse datasets to test AI models.

- Keep thorough documentation of efforts to reduce bias for audits.

Explainability and Transparency Issues

AI models are often complex, making it hard to explain how decisions are made. However, regulators are pushing for clearer explanations of financial decisions driven by AI. Tools like SHAP (SHapley Additive exPlanations) can help by showing which features influence specific outcomes [1].

Model Governance and Validation Challenges

Managing AI risks requires strong governance, with a focus on continuous monitoring and validation to ensure systems stay compliant and accurate. Here's a breakdown of key areas:

| Component | Key Actions | Validation Approach |

|---|---|---|

| Data Quality | Regular accuracy checks | Automated validation tools |

| Model Performance | Ongoing monitoring | Performance metrics tracking |

| Regulatory Compliance | Documenting system updates | Regular compliance audits |

| Risk Assessment | Evaluating potential risks | Stress testing scenarios |

Mitigating AI Compliance Risks

Data Governance Frameworks

For FinTech startups navigating AI compliance, having a strong data governance framework is essential. According to InnReg's research, this involves three main components: data quality validation, access management, and continuous compliance monitoring [1].

| Component | Implementation |

|---|---|

| Data Quality | Automated validation checks |

| Access Control | Role-based permissions |

| Compliance Tracking | Real-time monitoring tools |

These elements lay the groundwork for maintaining ethical AI practices.

Ethical AI Guidelines

To minimize bias risks, FinTech companies need well-defined ethical principles. Skadden's analysis emphasizes the importance of staying aligned with shifting regulatory expectations while fostering innovation [2]. Some key principles include:

- Ensuring fairness in algorithmic decision-making

- Implementing accountability measures for AI systems

- Conducting regular bias assessments

- Documenting ethical considerations clearly

Model Transparency and Interpretability

As highlighted in Section 3, meeting regulatory requirements for explainability is critical. Using feature attribution methods and explainable AI tools allows FinTech startups to maintain compliance without sacrificing efficiency [1].

Monitoring and Auditing AI Systems

Effective monitoring of AI systems requires attention to three critical areas:

-

Automated Performance Tracking and Documentation

Use continuous monitoring systems to track performance metrics and maintain detailed records for audits. -

Risk Assessment Protocols

Develop protocols to evaluate risks from both technical and regulatory perspectives, including stress tests and scenario analyses. -

Compliance Documentation

Keep thorough records of system updates, testing outcomes, and compliance checks to streamline regulatory audits.

Automated monitoring systems help startups stay compliant as they grow and scale operations.

sbb-itb-17e8ec9

Guidance for AI Risk Management & Regulatory Compliance

Using AI Tools for Compliance Management

AI tools are transforming how FinTech startups handle compliance, making processes faster and lowering operational risks. These technologies address key compliance challenges, align with governance frameworks (as covered in Section 4), and enable automated enforcement.

AI for Regulatory Intelligence

AI systems can process regulatory updates from over 120,000 sources in real time. For example, JPMorgan Chase reduced manual review time by 85% using such systems [3].

| Capability | Benefit |

|---|---|

| Real-time Monitoring | Provides instant alerts on regulatory changes |

| Pattern Recognition | Detects early trends in compliance |

| Cross-jurisdiction Analysis | Maps global regulatory requirements automatically |

| Risk Assessment | Spots potential compliance gaps proactively |

Automated Compliance Monitoring and Reporting

AI tools analyze transaction patterns at scale, flagging violations and unusual activities instantly [3]. This automation ensures consistent monitoring and minimizes human errors in compliance workflows.

Core features of AI monitoring include:

- Analyzing transaction patterns

- Automating regulatory reports

- Continuous compliance scoring

- Sending instant alerts for anomalies

Predictive Risk Assessment with AI

Machine learning enables startups to foresee compliance risks before they happen. By analyzing historical data and current market trends, these systems identify risks and suggest preventive actions, helping businesses stay resilient.

Lucid Financials: AI in Action for Compliance

Lucid Financials showcases how AI can streamline compliance by integrating tools into financial systems:

| Feature | Compliance Advantage |

|---|---|

| Real-time Financial Monitoring | Tracks compliance consistently |

| QuickBooks Integration | Validates financial data automatically |

| Scenario Planning | Assesses risks and suggests mitigations |

| Automated Reporting | Simplifies regulatory documentation |

Lucid Financials supports growing startups by providing real-time insights and seamless integration with existing systems, making it easier to meet compliance requirements.

Building a Compliance-Focused AI Culture

Integrating compliance into every layer of a FinTech startup is key to creating a strong foundation. This approach complements the technical measures covered in Sections 3-4 by addressing the human side of compliance.

Compliance in the AI Development Lifecycle

Using established governance frameworks helps manage AI-specific risks while keeping processes efficient [2].

Key compliance steps during development include:

- Design: Ensure model objectives align with regulatory standards.

- Testing: Include bias detection as part of validation protocols.

- Deployment: Automate monitoring processes as outlined in Section 4.

Employee Training and Awareness

Employee training should directly align with the ethical AI guidelines and monitoring systems discussed in Sections 3-4.

Key areas for training:

- AI and GDPR: Cover specific requirements related to data protection.

- Bias Detection: Teach employees to recognize bias in model outputs.

- Audit Documentation: Emphasize proper record-keeping for compliance reviews.

Collaboration Between Tech and Compliance Teams

Bridging the gap between technical and compliance teams is essential for effective AI governance. Cross-functional collaboration brings governance frameworks from Section 4 to life.

Steps to improve collaboration:

- Establish cross-functional compliance committees.

- Use shared documentation repositories to centralize information.

- Implement joint risk assessment workflows for a unified approach.

Technical teams must make their work clear and understandable for compliance officers. At the same time, compliance teams need enough technical knowledge to provide informed oversight. This partnership ensures startups can adapt the compliance frameworks from Section 2 to meet changing regulations without slowing down innovation.

Conclusion: Compliance and Scalability with AI

Three key strategies can help businesses grow while staying compliant:

Strategic Implementation of AI compliance is directly tied to scalable growth. Companies that focus on governance, validation, and cross-team collaboration when adopting AI [1] are better equipped to expand their operations effectively.

As noted in automated monitoring systems (Section 4), Real-time Compliance Management is now a cornerstone for modern FinTech. Advanced AI platforms (see Section 5) turn compliance into an advantage rather than a challenge. These tools integrate seamlessly with current systems, offering real-time insights that allow startups to stay compliant while driving growth.

"AI governance isn't about constraints - it's the framework for ethical innovation at scale."

Startups that succeed in balancing innovation and compliance often focus on:

- Establishing oversight processes (see Section 4.3) to monitor regulatory updates

- Creating modular compliance systems for flexibility

- Using AI tools (Section 5) to automate compliance tasks

- Encouraging collaboration between tech and compliance teams

The future of FinTech depends on using AI to its full potential while adhering to strict compliance rules. By prioritizing strong AI governance and compliance practices, startups can scale their businesses while maintaining both growth and accountability.