AI is helping businesses make faster, more accurate financial decisions by automating complex tasks and analyzing vast amounts of data. It predicts cash flow, identifies spending trends, and assesses risks, giving startups and SMBs tools once reserved for large corporations. Key benefits include:

- Time savings: Processes that took weeks now take minutes.

- Improved accuracy: Reduces human errors by automating data cleaning.

- Predictive insights: Forecasts trends and behaviors for informed decision-making.

- Real-time monitoring: Alerts businesses to risks and opportunities immediately.

For example, AI tools like ForecastMaster Pro achieve up to 93% accuracy in cash flow forecasting, while platforms like Lucid Financials simplify financial planning, saving businesses time and money. By integrating with systems like QuickBooks and payroll software, AI provides actionable insights tailored to business needs. With AI adoption in finance projected to reach 85% by 2025, embracing these tools can help businesses stay competitive in a fast-changing market.

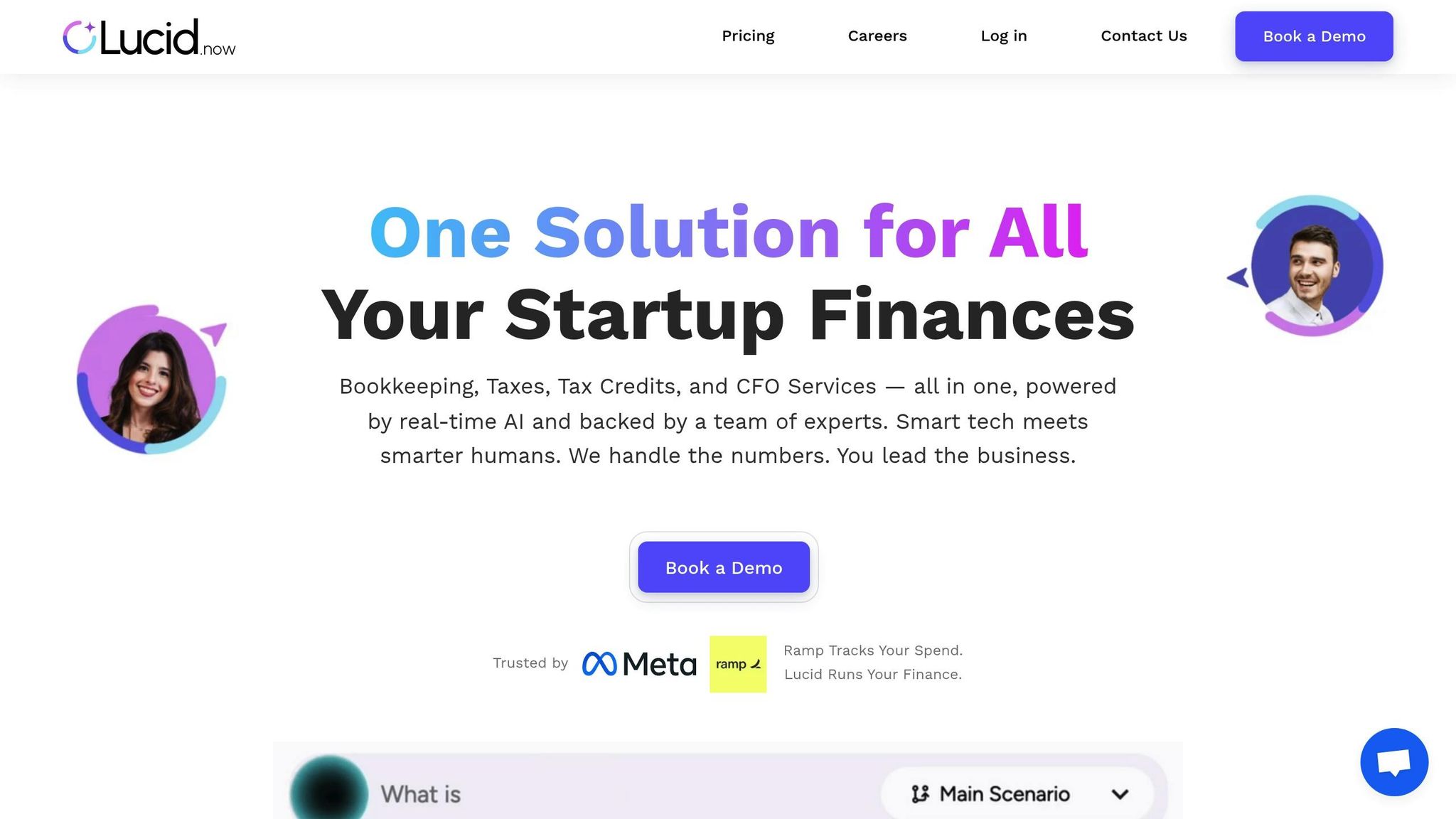

MIT Economist on Finance, AI, and Human Behavior

How AI Studies Financial Behavior

AI has revolutionized the way financial data is analyzed, turning raw numbers into actionable insights. By pulling information from multiple sources simultaneously, AI can quickly identify patterns and trends - tasks that would take traditional methods much longer to complete. This speed and efficiency come from its ability to integrate and process diverse data streams.

Data Sources AI Uses in Finance

AI-powered financial analysis relies on a variety of data sources to provide a comprehensive view of a business's performance:

- Bank transactions: These offer real-time insights into cash flow, including deposits, withdrawals, and payment trends. AI categorizes this data to detect spending habits, seasonal changes, and any unusual activity.

- Payroll systems: Workforce costs such as salaries, benefits, overtime, and headcount changes are tracked here. AI uses this data to predict labor expenses and uncover cost-saving opportunities. For businesses in the U.S., AI can also handle complexities like state tax rules and federal compliance requirements.

- Accounting software: Integration with platforms like QuickBooks gives AI access to income statements, balance sheets, and other critical financial documents. This ensures the data aligns with U.S. Generally Accepted Accounting Principles (GAAP).

Other valuable sources include credit card statements, invoice systems, inventory management software, and CRM tools. Together, these inputs allow AI to not only track what’s happening financially but also understand the reasons behind the numbers and predict future outcomes. The real power of AI lies in its ability to process all these data streams simultaneously while maintaining accuracy across the board.

Key Insights from Financial Data

AI doesn’t just analyze data - it extracts meaningful insights that drive smarter decision-making:

- Cash flow forecasting: Tools like ForecastMaster Pro achieve up to 93% accuracy for 90-day forecasts. This helps businesses anticipate cash shortages and confidently plan for major investments.

- Spending pattern analysis: AI uncovers where money is being spent, highlighting recurring costs, seasonal trends, and hidden inefficiencies. For instance, an eCommerce company using MarginMax AI identified underperforming SKUs, boosting its gross margin from 32% to 38% in just two months.

- Risk assessment: AI evaluates multiple risk factors - like customer payment behaviors and market volatility - simultaneously. This comprehensive view helps businesses better understand their exposure to various risks.

- Revenue optimization: By analyzing profit margins across products and services, AI pinpoints the most lucrative activities and customer segments, enabling businesses to focus resources where they’ll see the highest returns.

- Benchmarking: AI compares a company’s performance against industry standards, giving context to financial metrics. This helps businesses see whether they’re outperforming or lagging behind competitors.

These insights empower businesses to act quickly and make informed decisions, transforming how they approach financial planning.

Real-Time Benefits of AI in Decision-Making

AI’s ability to provide real-time financial analysis has changed the game for businesses, especially startups and small-to-medium-sized enterprises (SMBs). Platforms like Lucid Financials make it possible to respond to challenges and opportunities without delay.

- Immediate cash flow alerts and scenario modeling: Businesses can instantly assess the financial impact of decisions like hiring new staff, adjusting prices, or launching products. For example, a marketing agency in Boise used ForecastMaster Pro to anticipate a seasonal revenue dip in Q4, adjusting prices early and boosting profits by 8%.

- Automated financial reporting: AI keeps dashboards up to date, eliminating the need for manual updates. A seed-stage tech company using Zeni saved $80,000 annually by skipping the need for a full-time finance manager, reallocating those funds to product development.

- Predictive alerts: By monitoring multiple financial indicators, AI can provide early warnings about potential issues. This allows businesses to take corrective action before problems escalate.

- Efficient resource allocation: AI helps identify high-return opportunities, enabling businesses to redirect resources quickly and effectively.

With its ability to process vast amounts of data, deliver precise insights, and operate in real time, AI has leveled the playing field. Even startups and SMBs can now achieve the kind of financial sophistication that used to be reserved for large corporations with dedicated finance teams.

AI Methods for Financial Behavior Analysis

AI-powered tools have reshaped how businesses interpret financial data, diving deeper than just numbers. These methods dig into the reasons behind financial decisions and use that understanding to predict future trends with impressive precision.

Machine Learning Models in Finance

Machine learning models form the backbone of modern financial analysis, with each type specializing in a unique way of interpreting data. For example, supervised learning models shine when it comes to making predictions based on historical data. They’re ideal for tasks like forecasting next quarter’s revenue or identifying customers who might miss payments.

On the other hand, unsupervised learning models excel at finding hidden patterns. These are particularly useful for segmenting customers by spending habits or spotting unusual cost structures. For startups and small businesses, these insights can reveal trends that might otherwise go unnoticed with manual analysis.

Anomaly detection models act as financial watchdogs, constantly scanning transactions for irregularities. Think of them as the system that flags a sudden spike in office supply spending or an unexpected payment to a new vendor. These models are also highly effective in tracking irregular stock price movements. By processing enormous datasets quickly, they can uncover subtle patterns that would take humans much longer to identify. Increasingly, AI-powered revenue analytics platforms are gaining traction for their ability to interpret complex data in real time, offering businesses immediate insights into their performance.

One of the standout features of these models is their ability to respond to plain language queries. For instance, a business owner can ask, “What’s causing our highest expenses this month?” and receive immediate, data-driven answers. This eliminates the need to spend hours analyzing spreadsheets and empowers decision-making on the fly.

Building on these capabilities, reinforcement learning takes things a step further by adapting dynamically to changing financial environments.

Reinforcement Learning for Financial Optimization

Reinforcement learning (RL) represents a cutting-edge approach to financial analysis, using an agent that learns and improves decisions through trial and error.

"The decisions a trader makes are not one-time events but evolve over time. Every decision impacts the next, much like in the trading world where positions are adjusted continuously based on market conditions." - Dr. Yves J. Hilpisch

This method is particularly well-suited for scenarios where decisions are interconnected. The RL framework consists of an agent (decision-maker), an environment (the financial system), and a reward mechanism that evaluates the quality of decisions.

In one study, an RL agent tested on five financial assets over two years achieved a profitability rate of 40% after 212 days. This outperformed traditional strategies like the Equally Weighted Portfolio (22%) and Markowitz Portfolio Optimization (20%). It also delivered a higher average daily return (0.16%) compared to Markowitz (0.11%) and Equally Weighted (0.10%) portfolios.

"Finance is filled with dynamic decision problems, from options pricing to portfolio optimization, that can be effectively modeled as MDPs. Reinforcement learning allows us to tackle these problems by learning from the environment in real time." - Dr. Yves J. Hilpisch

For startups and small businesses, RL can optimize areas like cash flow management, investment timing, and resource allocation. Unlike traditional methods that rely on static rules, RL adapts to market changes, handles complex data, and makes sequential decisions under uncertainty. By learning from feedback, it discovers strategies that go beyond typical human intuition. Its applications span algorithmic trading, risk management, market making, and fraud detection. However, successful implementation requires attention to data quality, regulatory compliance, and avoiding overfitting.

This dynamic approach complements other AI methods by refining real-time financial decision-making.

Traditional vs. AI-Driven Methods Comparison

AI-driven analytics stand out when compared to traditional methods, offering faster, more accurate, and adaptable solutions. Here’s how they stack up:

| Criteria | Traditional Analytics | AI-Powered Analytics |

|---|---|---|

| Data Handling | Limited to structured data; struggles with unstructured or large datasets | Processes structured, unstructured, and large-scale data with ease |

| Speed & Responsiveness | Focuses on historical data; slow to react to real-time events | Analyzes live data streams instantly, enabling immediate responses |

| Scalability | Requires manual effort and resources to scale | Scales effortlessly with automation and cloud technology |

| Accuracy & Bias | Prone to human error and bias; limited flexibility | Continuously improves, reducing bias and increasing precision |

| Usability | Requires experts for interpretation | User-friendly interfaces and natural language queries make insights accessible |

| Adaptability | Relies on static models needing frequent updates | Learns from new data and adapts automatically |

| Insight Type | Focuses on what happened and why | Predicts future outcomes and suggests actions |

| Decision Support | Reactive, based on past trends | Proactive, offering forward-looking strategies with real-time data |

Behavioral finance adds another layer of complexity that AI handles more effectively than traditional methods. While conventional finance assumes rational decision-making, behavioral finance considers psychological and emotional factors. AI can analyze large datasets to uncover patterns and predict behaviors that traditional models might miss.

The shift toward AI-driven methods is evident in adoption trends. For instance, 75% of wealth management executives are optimistic about AI’s potential, with 49% of firms already using it in some capacity and 73% planning to expand their use within two years. Additionally, 65% of high-net-worth individuals acknowledge that biases influence their investment decisions, while 79% believe that guidance from relationship managers can help mitigate these biases. AI models consistently outperform traditional methods in predictive accuracy, adaptability, and risk management. Their ability to process multiple variables simultaneously and learn continuously makes them indispensable for proactive decision-making.

This growing reliance on AI highlights its transformative role in financial decision-making, especially for startups and small businesses navigating complex markets.

Real Applications for Startups and SMBs

Using AI for financial analysis might seem daunting at first, but startups and small-to-medium businesses are finding ways to make it work without needing a huge budget or advanced technical skills. By taking a practical approach, these businesses are successfully applying AI methods to streamline their financial operations.

Steps to Set Up AI-Driven Analysis

You can start incorporating AI into your financial processes by building on the systems you already have in place.

- Set clear goals and metrics for success. Defining measurable objectives is key to evaluating whether AI is delivering results. For instance, 57% of CFOs report fewer sales forecast errors due to AI, and 58% of finance teams are piloting AI tools in 2024, up from 37% the previous year.

- Start small with a pilot project. Instead of overhauling your entire financial system, focus on a specific area like cash flow forecasting or expense categorization. This lets you test the waters without overwhelming your team or disrupting operations.

- Clean and organize your data. AI thrives on good data. Standardize entries, fix inconsistencies, and ensure your accounting records are up-to-date. Poor data quality is a common hurdle, with 35% of CFOs identifying it as a major barrier to adopting AI in finance. Tools like QuickBooks and payroll systems can help centralize your data.

- Train your team. It's not just about using the tools - it’s about understanding how AI works, what influences its predictions, and when to rely on its recommendations. This knowledge empowers your team to make informed decisions based on AI insights.

- Set up monitoring systems. Automated alerts for unusual patterns in forecasts or data help maintain accuracy and catch potential issues early. Regular monitoring ensures your AI tools stay reliable.

Once these steps are in place, platforms like Lucid Financials can deliver immediate, actionable insights.

Features and Benefits of Lucid Financials

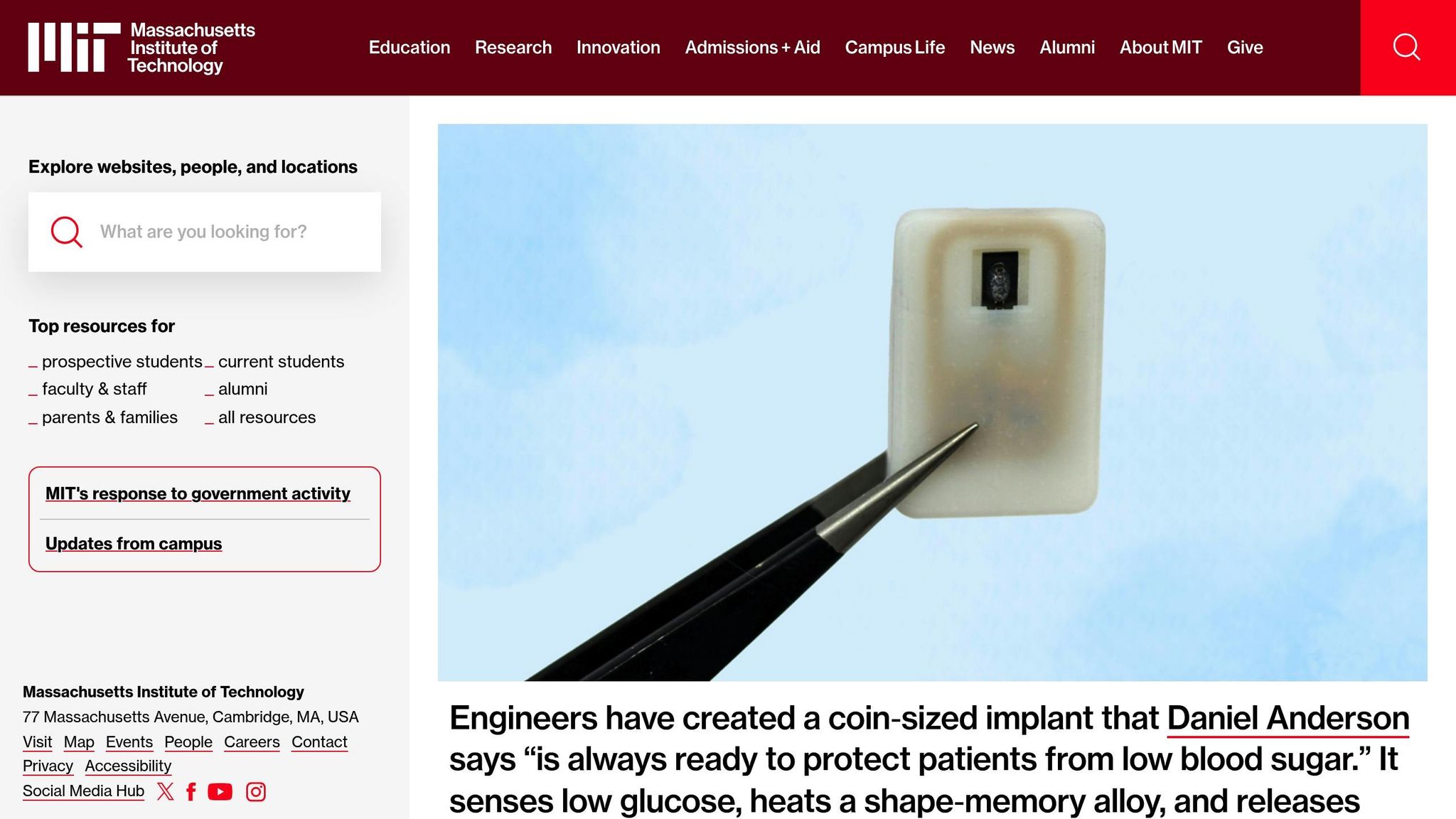

Lucid Financials is designed to simplify financial planning for startups and SMBs, offering advanced tools without the need for a dedicated data science team.

-

Instant financial planning. The platform generates detailed financial models - covering best-case, worst-case, and actual scenarios - almost instantly. This is a game-changer for startups that need to pivot quickly or respond to investor demands on tight timelines.

"Our AI-driven solutions make financial management 100x faster" – Lucid Financials

- Real-time cost analysis. By connecting directly with systems like QuickBooks, payroll tools, and banks, Lucid Financials provides up-to-date insights into cash flow, expenses, and revenue. This eliminates the need for manual data entry and helps businesses identify financial issues before they escalate.

- Scenario forecasting. You can explore multiple financial scenarios to evaluate strategies like hiring, launching new products, or expanding into new markets. For example, you can model how adjusting marketing spend might impact your runway or how hiring new staff could influence cash flow.

- Industry benchmarks. Lucid Financials offers tailored comparisons to similar businesses, helping you gauge your performance on key metrics like Customer Acquisition Cost (CAC) and valuation multiples. These insights can guide strategic improvements.

- Simplified reporting. Creating professional financial reports for investors or board members becomes much easier. Instead of spending hours formatting spreadsheets, you can generate polished reports that clearly communicate your financial health and growth.

Users of Lucid Financials have shared positive feedback. Refael Shamir, Founder and CEO of Letos, said:

"We found a powerful yet simple solution for our financial planning needs, which has been a great addition to our business"

Similarly, Luka Mutinda, Founder and CEO of Dukapaq, noted:

"As our company grows, budgeting and cash flow management have become crucial. The features provided are essential and have greatly streamlined these processes for us"

Best Practices for Using AI Recommendations

To get the most out of AI insights, pair them with human judgment.

- Combine AI with human expertise. AI is excellent at crunching numbers and spotting patterns, but it’s up to you to interpret these results within the broader context of your business. For example, market conditions or company culture might not be fully captured in the data.

- Regularly review and validate AI outputs. Keep track of how AI recommendations perform over time. If a forecast seems off, dig deeper to understand why. Systematic reviews help you refine processes and ensure the AI remains a helpful tool.

- Tailor reports for your audience. Different stakeholders need different levels of detail. For instance, your operations team might need a detailed breakdown of expenses, while investors are more interested in high-level growth projections.

- Start with low-risk decisions. Test AI insights on decisions with minimal downside, like optimizing purchase timing or reallocating marketing budgets. As you gain confidence, you can apply AI to more critical financial decisions.

According to Gartner, by 2028, half of all organizations will use AI to replace traditional forecasting methods. Businesses that adopt AI-driven financial tools now will be better positioned to stay ahead as these technologies become the norm.

sbb-itb-17e8ec9

Maintaining Data Quality and Compliance

For AI to genuinely enhance your financial decision-making, it needs clean, reliable data and adherence to regulatory standards. Without these, even the most advanced AI tools can lead to errors that could harm your business.

Data Quality for Accurate AI Analysis

Bad data equals bad results. Consider this: only 3% of business data meets basic quality standards, and 47% of new records contain critical errors. These issues cost businesses an average of $15 million annually.

Start by profiling your data to identify issues like missing values, incorrect data types, or figures that aren't within reasonable ranges. Standardizing formats - such as dates (MM/DD/YYYY), currency ($1,234.56), and numerical data - across systems like QuickBooks and payroll is crucial for accurate analysis. For instance, negative revenue values or salaries recorded as text can throw AI models off track.

"Any AI model is based on the data used for its training. The data has to be clean, well-organized, and representative. This means the removal of inconsistencies, errors, or biases in the data."

- Emad Ayyash, Head of Digital Financial Services at Finance House

Automated data validation rules can act as your safety net. These rules might include ensuring expense amounts are positive, checking that dates fall within realistic ranges, or verifying that vendor names match your approved list.

"Maintaining accuracy with AI solutions is paramount in the quest for efficient financial data analysis. It starts with robust data governance ensuring data quality and relevance through rigorous validation processes."

- Isfar Faruk Shakif, BBA || SBE || Finance || Finance Enthusiast

Once your data is in order, the next step is ensuring compliance with regulatory and security standards.

Regulatory and Security Requirements

While the U.S. doesn’t yet have comprehensive AI laws, existing financial regulations still apply to AI-driven decisions. In 2024 alone, Congress introduced over 40 AI-related bills aimed at promoting responsible AI use. Agencies like the Consumer Financial Protection Bureau (CFPB) are particularly focused on protecting consumer privacy and ensuring ethical AI practices.

A 2024 survey revealed that 80% of American banking professionals are concerned about bias in AI models, 77% worry about losing client trust, and 73% fear exposing sensitive customer data or creating cybersecurity risks. These concerns highlight the need for safeguards.

Businesses must comply with privacy laws, fair lending rules, disclosure requirements, and risk management protocols when using AI. Transparency is especially critical for customer-facing applications - customers need to understand how AI impacts decisions that affect them.

Recent enforcement actions emphasize the risks of non-compliance. In 2022, iTutor Group, a China-based company, was fined $365,000 by the EEOC for using AI in hiring practices that discriminated based on age. Similarly, California-based Hello Digit was fined $2.7 million after its AI algorithm caused users to incur unnecessary overdraft fees.

As reliance on third-party AI providers grows, businesses must carefully vet these vendors. For example, if you’re using a platform like Lucid Financials, you’re entrusting them with sensitive data. Make sure they have strong security measures and clear data-handling policies.

For startups and small businesses, following these protocols not only protects sensitive information but also builds trust in AI-driven financial decisions.

Connecting AI with Financial Systems

Once compliance measures are in place, the next step is integrating AI with your financial systems. Platforms like QuickBooks, payroll software, and bank accounts can be connected to AI tools to streamline the flow of sensitive data.

Currently, 68% of financial services firms prioritize AI for risk management and compliance, yet over 38% lack a formal strategy for evaluating how and when to use AI tools. This gap underscores the importance of strong governance.

To keep data secure during integration, encryption is a must. Only authorized users should have access, which can be managed through role-based access controls (RBAC). Regular backups - whether through cloud storage or external devices - are equally important to safeguard against technical failures, cyberattacks, or human error.

A centralized document management system (DMS) can also play a crucial role. By securely storing contracts, tax files, and transaction records, a DMS ensures critical documents are protected while still feeding relevant data into AI systems for analysis.

Employee training is another key factor when integrating AI. Your team should be equipped to recognize AI-related security threats and maintain data integrity across connected platforms. Alarmingly, 38% of companies haven’t tested or validated the quality of their AI outputs, which makes regular system evaluations essential.

Testing and validating integrated systems on a regular basis ensures that everything runs smoothly as your business scales. This includes checking data flows between systems, comparing AI outputs to known benchmarks, and monitoring for unusual patterns that could indicate security breaches or data corruption.

Conclusion: Changing Financial Decisions with AI

AI is reshaping how startups and small businesses tackle financial decision-making, turning what used to take weeks of manual effort into minutes of automated insights. This shift from traditional spreadsheet-heavy methods to AI-powered analysis isn’t just a tech upgrade - it’s a complete overhaul in how businesses understand and optimize their financial strategies.

Recent data highlights this transformation. AI adoption in finance has jumped significantly, with usage rising from 45% in 2022 to a projected 85% by 2025. Alongside this growth, companies are seeing real-world benefits, such as a 45% reduction in case resolution times and a 35% improvement in customer retention rates.

Platforms like Lucid Financials are at the forefront of this change. By integrating critical financial data, Lucid Financials enables businesses to create full financial plans in just minutes, replacing hours of manual work. This kind of efficiency is invaluable for startups and SMBs looking to stay competitive in a fast-paced market.

AI isn’t just about automating repetitive tasks - it’s also about offering predictive insights. Advanced models can now identify spending trends, forecast cash flow, and recommend resource allocation based on historical data and industry standards. These predictive capabilities, powered by machine learning and reinforcement learning, are leveling the playing field, giving smaller businesses access to tools that were once only available to large corporations. The result? Smarter decision-making, improved risk management, and stronger business outcomes.

With the U.S. AI market expected to reach $826.70 billion by 2030, businesses that adopt AI-driven financial tools today are setting themselves up for long-term success. The future of financial decision-making has arrived, and it’s driven by AI.

FAQs

How does AI help startups and small businesses make smarter financial decisions?

How AI Supports Smarter Financial Decisions for Startups and Small Businesses

AI is transforming the way startups and small businesses handle their finances by processing massive amounts of data with speed and precision. This means businesses can gain real-time insights, improve their forecasting, and make well-informed plans. By taking over repetitive tasks, AI not only reduces human error but also frees up time for teams to zero in on strategies that drive growth.

Take cash flow management, for example. AI can streamline this process, compare different financial scenarios, and even pinpoint industry benchmarks to steer better decision-making. These tools give startups and small businesses a real advantage, enabling them to grow efficiently and stay agile in a constantly shifting market.

What types of data does AI use to analyze financial behavior, and how is it integrated?

AI taps into a variety of data sources to analyze financial behavior effectively. These include market data, financial statements, and alternative data like customer behavior trends or economic signals. It also uses real-time data pulled from tools such as accounting software, payroll systems, and banking platforms.

To handle this data, AI systems rely on automated processes for collecting, cleaning, and syncing information. This ensures the data is accurate, current, and primed for analysis, enabling businesses to make informed financial decisions and extract actionable insights faster.

How can startups and small businesses maintain data accuracy and ensure compliance when using AI for financial analysis?

Startups and small businesses can significantly improve data accuracy by using AI-powered tools designed to clean and organize information. These tools can automatically spot errors, standardize formats, and eliminate duplicates, making data more reliable for insights and better decision-making.

On top of that, implementing AI solutions focused on compliance can streamline the process of monitoring regulations, identifying inconsistencies, and creating audit-ready reports. This reduces the chances of falling out of compliance. To further strengthen data integrity, businesses should prioritize regular data reviews, establish strong governance practices, and conduct frequent audits. When these approaches are combined, companies can confidently use AI for financial analysis while keeping risks in check.