Unit economics helps startups measure profitability per unit sold. Tools like calculators simplify this process by automating calculations for key metrics like Customer Acquisition Cost (CAC) and Lifetime Value (LTV). Here are 5 free options to consider:

- Lucid Financials: Tracks CAC, LTV, churn, and more. Integrates with QuickBooks and payroll systems. Free for 1 user.

- ZORP Calculator: Breaks down costs (COGS, labor, marketing) and offers actionable insights to improve profitability.

- Board of Innovation Toolkit: Features a Unit Economics Canvas for metrics like profit margins and break-even analysis.

- Fuelfinance Engine: Automates data collection and tracks metrics like LTV and EBITDA in real-time. Includes financial guidance.

- Prodpapa Analyzer: Focuses on unit profitability, break-even points, and detailed cost structures.

Quick Comparison Table

| Tool | Key Metrics | Integration | Scenario Planning | Free Version Limits |

|---|---|---|---|---|

| Lucid Financials | LTV, CAC, Churn Rate | QuickBooks, Payroll | 2 scenarios | 1 user, basic models |

| ZORP Calculator | Revenue, Costs, Profit | Manual Input Only | Single scenario | Unlimited usage |

| Board of Innovation | Profit Margins, Break-even | Spreadsheet Export | Multiple scenarios | Template download |

| Fuelfinance | LTV, CAC, EBITDA | Cloud-based Import | 3 scenarios | Basic calculations |

| Prodpapa | Unit Profitability | Manual Input Only | Multiple scenarios | Basic features |

These tools help startups assess financial health, improve pricing, and plan for growth. Choose based on your business model and integration needs.

Unit Economics of Ecommerce Growth

1. Lucid Financials Unit Economics Module

Lucid Financials' Unit Economics Module gives startups a clear view of essential metrics, helping them understand and improve their financial performance. Designed with early-stage ventures in mind, the free plan allows access for one team member and unlimited view-only users - perfect for small teams just starting out. Here's a closer look at what it offers.

One of the module's standout features is its ability to automatically calculate and monitor key unit economics metrics. As Sam Altman once pointed out:

"Most great companies historically have had good unit economics soon after they began monetizing, even if the company as a whole lost money for a long period of time."

This tool integrates seamlessly with QuickBooks, payroll systems, and banks to provide a comprehensive, real-time financial overview - all in one place.

Key Features of the Free Unit Economics Module

| Feature | Description |

|---|---|

| Basic Financial Models | Pre-built templates to calculate CAC, LTV, and margins |

| Scenario Planning | Test up to 2 different scenarios to evaluate assumptions |

| Real-time Dashboard | Visualize critical metrics and trends at a glance |

| Integration Support | Connect with accounting software for streamlined data |

| Reporting | Generate essential reports for smarter decision-making |

The module continuously tracks metrics like Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), Gross Margin per Unit, Payback Period, and Customer Churn Rate. This automated tracking eliminates the need for manual calculations, making it easier for startups to focus on refining their strategies. Additionally, the AI-driven scenario planning tool allows teams to model different outcomes without wrestling with complex spreadsheets.

While the free plan doesn't include some advanced features, it offers everything a startup needs to start tracking and improving its unit economics. Its user-friendly design ensures that even those without a strong financial background can easily navigate and make use of the platform.

2. ZORP Unit Economics Calculator

Building on the insights from Lucid Financials, ZORP introduces its own approach with an easy-to-use calculator. The ZORP Unit Economics Calculator is a practical tool designed to help startups measure and fine-tune their per-unit profitability across various industries.

The calculator streamlines the process with six essential input categories:

| Input Category | Purpose |

|---|---|

| Quantity Sold | Tracks sales volume |

| Price per Item | Sets product pricing |

| COGS | Calculates production costs |

| Administrative Costs | Monitors overhead expenses |

| Labor Costs | Tracks workforce expenses |

| Miscellaneous Costs | Accounts for additional expenses |

By breaking down costs, the calculator transforms raw data into actionable insights. For example, ZORP shared a case study where a consumer-focused business achieved an impressive 50% profit margin by leveraging detailed cost analysis.

If the results reveal a negative net profit, the tool offers actionable suggestions, such as:

- Identifying areas for cost reduction

- Reevaluating pricing strategies

- Reviewing operational efficiency

- Examining the effectiveness of marketing efforts

For startups with complex operations, ZORP also integrates inventory and supply chain management tools. These features help optimize stock levels and cut unnecessary expenses, providing clear insights into per-unit revenue and profit. This equips businesses to make smarter, data-driven decisions.

3. Board of Innovation Validation Toolkit

The Board of Innovation Validation Toolkit includes the Unit Economics Canvas, a handy calculator designed to evaluate four critical metrics for unit economics:

| Key Metric | Purpose | Example |

|---|---|---|

| Selling Price Per Unit | Assesses revenue potential | $10 |

| Gross Profit Margin | Gauges operational efficiency | 60% |

| Lifetime Purchases | Estimates customer value | 2 purchases |

| Customer Acquisition Cost | Measures marketing efficiency | $5 |

In March 2025, Jeroen Coelen showcased its real-world application by analyzing a hotdog drone delivery startup. This example highlighted how the toolkit can even support unconventional business models.

The toolkit uses a step-by-step validation process:

- Individual Assessment: Team members independently identify the key figures required to calculate their business model metrics.

- Team Alignment: The team then collaborates to review findings and agree on a unified method for calculations.

- Data Validation: Finally, theoretical assumptions are translated into concrete numbers, using industry benchmarks and informed estimates.

This structured method has been successfully applied across industries like Consumer Goods, Healthcare, Financial Services, and Food & Beverage. Startups are encouraged to run these calculations early - once they have a clear product concept. Doing so helps pinpoint potential profitability challenges before significant resources are invested. This systematic approach not only refines financial projections but also lays the groundwork for comparing features and metrics in greater depth.

sbb-itb-17e8ec9

4. Fuelfinance Automated Economics Engine

Fuelfinance's Automated Economics Engine provides real-time insights into unit economics by seamlessly integrating data from platforms like QuickBooks and others. It tracks critical metrics such as Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC) with precision.

Take Petcube, for instance: their forecasts using this tool deviated by only 2–5% from targets. The result? Outcomes that were five times more effective and ten times less expensive compared to managing the process in-house.

Key Components of the Engine

| Component | Function | Impact |

|---|---|---|

| Automated Data Collection | Automatically pulls and categorizes up to 80% of transactions | Saves significant time on manual data entry |

| Pipeline Analytics | Links revenue forecasts with hiring and expense planning | Supports accurate growth strategies |

| Real-time Monitoring | Tracks daily unit economics metrics | Enables faster, informed decisions |

These features form the backbone of success for diverse businesses. For example, O0 Design used the automated data collection feature to cut their financial management time in half while achieving double the year-over-year growth.

In addition to automation, Fuelfinance goes a step further by offering expert financial guidance. Startups gain access to a dedicated financial manager who acts as an outsourced CFO, helping them analyze unit economics and make smarter decisions.

"We combine a proprietary financial tech platform with finance and accounting professionals who analyze clients' data and offer insights." – Fuelfinance

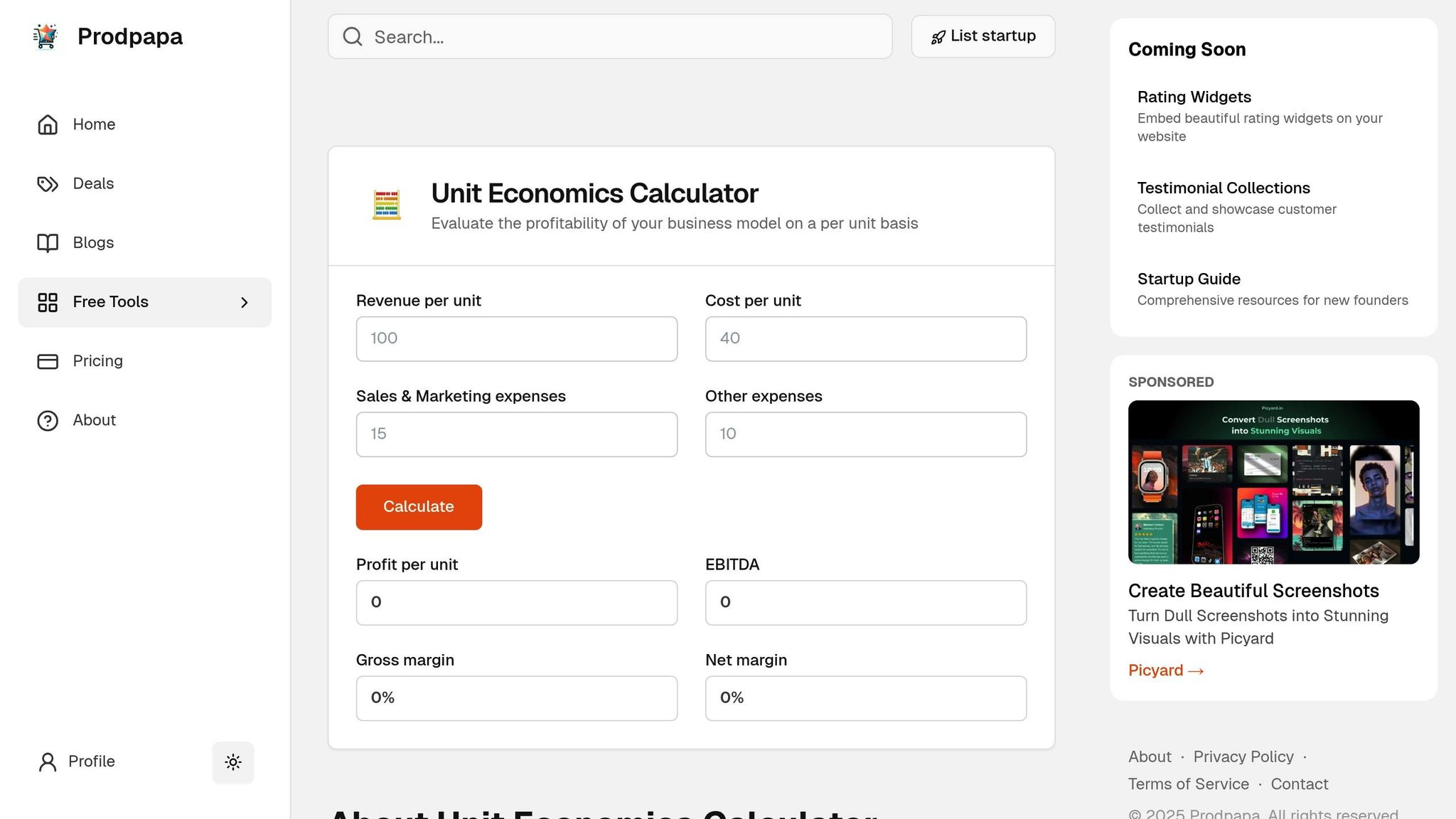

5. Prodpapa Unit Profitability Analyzer

The Prodpapa Unit Profitability Analyzer wraps up the list by offering detailed insights into the financial performance of individual units. It simplifies complex data into practical takeaways, helping businesses validate their models and fine-tune pricing strategies.

Key Unit Profitability Metrics

| Metric | Formula | Business Impact |

|---|---|---|

| Profit Per Unit | Revenue – (Cost + Marketing + Other Expenses) | Identifies exact profit per unit |

| EBITDA | Profit Per Unit + Other Expenses | Evaluates operational efficiency |

| Gross Margin | ((Revenue – Cost) / Revenue) × 100% | Measures pricing effectiveness |

| Net Margin | (Profit Per Unit / Revenue) × 100% | Assesses overall profitability per unit |

The analyzer caters to both product and service-based businesses. For product-focused companies, it considers manufacturing costs, inventory dynamics, and economies of scale. Service businesses can evaluate profitability by examining factors like service hours, consultant expenses, and utilization rates.

Break-Even Analysis Features

This tool also includes a break-even calculator, which is invaluable for startups and businesses looking to determine the minimum number of units needed to cover all costs. It’s especially useful for launching new products, planning expansions, analyzing cost reductions, and evaluating promotions.

Break-even analysis plays a critical role in business planning, pricing decisions, and assessing financial risks. A lower break-even point often signals a more resilient and adaptable business model.

Beyond basic calculations, the analyzer allows users to input variables like revenue per unit, direct costs, and marketing expenses to create various scenarios. This capability empowers users to experiment with pricing, optimize costs, and make informed decisions about scaling. By providing this level of detail, the tool enables businesses to compare unit economics and metrics effectively across different scenarios.

Features and Metrics Comparison

Here's a breakdown of the main features and metrics for these free unit economics calculators. The table below offers a quick side-by-side comparison:

| Feature/Capability | Lucid Financials | ZORP Calculator | Board of Innovation | Fuelfinance | Prodpapa |

|---|---|---|---|---|---|

| Core Metrics | LTV, CAC, Churn Rate, MRR | Revenue, COGS, Net Profit | Break-even Analysis, Profit Margins | LTV/CAC Ratio, EBITDA | Unit Profitability, Break-even Point |

| Integration Options | QuickBooks, Payroll Systems, Banks | Manual Input Only | Spreadsheet Export | Cloud-based Import | Manual Input Only |

| Scenario Planning | 2 scenarios (free) | Single Scenario | Multiple Scenarios | 3 Scenarios | Multiple Scenarios |

| Data Export | PDF, Excel | Excel, Google Sheets | PDF, Excel | ||

| Free Version Limits | 1 team member, basic models | Unlimited usage | Template download | Basic calculations | Basic features |

Advanced Analytics Features

Each calculator brings its own strengths when it comes to analytics. Here’s how they stack up:

- Revenue Analysis: Lucid Financials dives into recurring revenue and growth trends, while ZORP keeps it simple with basic revenue calculations.

- Cost Structure: Tools like Fuelfinance and Prodpapa focus on breaking down cost structures, helping businesses uncover optimization opportunities.

- Profitability Metrics: Board of Innovation excels at validating profitability assumptions and assessing market viability.

Industry-Specific Considerations

The right tool often depends on your business model. For SaaS companies, insights like LTV/CAC ratios are crucial. On the other hand, businesses dealing with physical products may prioritize tools that highlight contribution margins.

Data Management Capabilities

How these calculators handle data can make or break their usability. Here’s a closer look at their approaches:

- Real-time Updates: Lucid Financials stands out with live integration for automatic data syncing.

- Manual Input: ZORP and Prodpapa allow users to manually input data, making them more customizable.

- Template-Based Systems: Board of Innovation provides pre-built templates that users can download and modify to suit their needs.

Key Takeaways

Here’s a closer look at the main points to keep in mind when using these calculators to guide your business strategy:

- Evaluating Financial Health These tools are designed to help you assess whether your business model is sustainable. They provide valuable insights into how efficiently your operations are running and highlight areas with growth potential.

- Making Smarter Decisions With data at your fingertips, you can make informed choices about pricing, marketing strategies, and resource allocation. This can lead to noticeable improvements in profitability.

-

Planning for Growth

Monitoring unit economics empowers startups to:

- Adjust product pricing for better profitability

- Boost the effectiveness of marketing efforts

- Plan for scalable, long-term growth

- Allocate resources more effectively

- Communicating with Investors Clear, quantifiable metrics from these calculators can demonstrate your business's efficiency and growth potential, making them a powerful tool when pitching to investors.

-

Tracking Performance and Adapting

To get the most out of these calculators, startups should:

- Recalculate Customer Acquisition Cost (CAC) whenever there’s a change in advertising budgets.

- Update unit economics whenever there are shifts in pricing or costs.

- Focus on increasing Lifetime Value (LTV) rather than solely cutting acquisition costs.

- Strive for a CAC payback period of under 12 months.

These takeaways highlight how automated unit economics tools can play a critical role in shaping a startup’s financial strategy and driving success.

FAQs

How can unit economics calculators help startups boost profitability and make smarter financial decisions?

Unit economics calculators are essential tools for startups looking to measure profitability on a per-unit basis. They break down crucial metrics like customer acquisition cost (CAC) and lifetime value (LTV), offering a clear picture of whether each sale contributes to sustainable profits. This information is key for making smarter decisions about pricing, marketing strategies, and how to allocate resources effectively.

By understanding unit economics, startups can pinpoint their most profitable offerings, fine-tune spending, and prioritize strategies that fuel growth without sacrificing profitability. These insights play a vital role in scaling a business while keeping its financial foundation strong.

What should startups look for when choosing a free unit economics calculator?

When considering a free unit economics calculator, startups should focus on a few important factors to ensure it aligns with their needs.

First, the calculator should cover key metrics such as Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Gross Margin. These numbers are essential for assessing profitability and planning for long-term growth.

Second, choose a tool that allows for customization to fit your business model. This means being able to input various cost structures - both fixed and variable - as well as multiple revenue streams. After all, every industry and business operates differently, and the calculator should reflect that.

Lastly, prioritize tools that are easy to use and work well with your current financial systems. A user-friendly interface that integrates smoothly with software like QuickBooks or payroll systems can save you time, reduce mistakes, and help you make smarter, data-backed decisions without disrupting your workflow.

How can startups use unit economics to showcase growth potential to investors?

Startups can use unit economics to paint a clear picture of their growth potential by focusing on the profitability and scalability of their business model. Metrics like Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV) are especially important. These numbers help investors gauge how much profit the business generates per customer and whether it can maintain sustainable growth over time.

Strong unit economics give startups a way to highlight their ability to scale efficiently while working toward long-term profitability. This not only boosts investor confidence but also reflects a well-thought-out strategy for pricing, marketing, and operations. When presented effectively, unit economics can make a startup stand out as a compelling investment opportunity.