Startups often fail due to cash flow issues and poor financial visibility. Multi-dimensional reporting solves these problems by offering real-time, customizable insights into financial and operational data. Unlike static, one-size-fits-all reports, this approach categorizes data by key areas like departments, products, and regions, enabling better decision-making and faster responses to challenges. With features like AI-powered forecasting and stakeholder-specific reports, startups gain the tools needed to manage growth, improve efficiency, and attract investors.

Key Takeaways:

- 82% of startups fail due to cash flow mismanagement.

- Multi-dimensional reporting integrates real-time data and predictive analytics for dynamic insights.

- It organizes data by categories (e.g., departments, regions) for targeted analysis.

- Customizable reports meet the needs of investors, board members, and internal teams.

- AI tools enhance forecasting and risk management.

Startups using multi-dimensional reporting save time, reduce errors, and make smarter financial decisions, ensuring they stay competitive in fast-changing markets.

How to Implement Financial MIS for Startups

Understanding Multi-Dimensional Reporting

Traditional reporting provides a single, static view, while multi-dimensional reporting offers a dynamic, real-time perspective into every aspect of your operations. This shift transforms how businesses analyze and act on data, laying the groundwork for more precise and actionable insights.

"Multidimensional accounting is a simplified approach to financial reporting that provides businesses with a more detailed and informative view of their operations." - Marshall Hargrave

This quote highlights the value of multi-dimensional analysis. The main difference lies in how data is structured and examined. Traditional reporting often focuses on one-dimensional metrics, such as total expenses over a specific period. Multi-dimensional reporting, on the other hand, allows for deeper analysis - like breaking down spending by department or initiative - enabling more informed and targeted decisions.

Key Features of Multi-Dimensional Reporting

For startups grappling with fragmented data, multi-dimensional reporting offers a solution by organizing information through dimensions, which act as tags to group and filter data by categories like organizational details or revenue drivers. Transactions are automatically categorized across multiple dimensions, simplifying analysis.

One standout feature is real-time data updates, ensuring your insights are always current. Instead of being limited to static, predefined reports, you can apply filters, switch between dimensions, and create custom views on the fly. The system also lets you save navigation states and layouts, making it easy to refresh complex analyses and export results for stakeholders such as investors or board members.

| Common Dimensions | Description |

|---|---|

| Departments | Evaluate financial performance within specific departments |

| Products or Services | Assess profitability or costs tied to various offerings |

| Regions | Analyze revenue and expenses by geographic area |

| Projects | Track profitability for individual projects |

How Multi-Dimensional Reporting Improves Financial Clarity

Startups often face challenges like cash flow management and forecasting, making comprehensive financial insight crucial. Multi-dimensional reporting addresses these issues by offering a complete view of your business. Research shows that data-driven organizations are 23 times more likely to acquire customers and 6 times more likely to retain them. This approach uncovers trends, outliers, and correlations that traditional reporting methods frequently miss.

With multi-dimensional reporting, decisions are driven by solid data rather than guesswork. Real-time insights allow businesses to act quickly, whether it’s managing cash flow or adjusting strategies.

Additionally, poor data quality can cost organizations an average of $12.9 million annually. By automating and standardizing analysis, multi-dimensional reporting minimizes errors and helps startups shift from reactive problem-solving to proactive strategic planning.

Problems Startups Face Without Multi-Dimensional Reporting

Startups often find themselves stuck in growth and efficiency roadblocks when they rely on basic reporting systems.

Fragmented and Isolated Data

For many startups, data lives in silos - spread across various systems like CRM platforms, accounting software, and project management tools. This fragmentation creates a major challenge: it becomes nearly impossible to get a complete picture of business performance.

"Comprehension of data decreases every time we have to flip a page to compare two sets of information. Proximity is the key to forming relationships between data." - Edward Tufte, Statistician and data visualization expert

A staggering 80% of organizations store more than half of their data across multi-cloud or hybrid infrastructures, which only adds to this fragmentation. The result? Inconsistent data across teams, headaches when trying to integrate information, and delays in retrieving insights when time is of the essence. For example, if marketing spend can't be matched with revenue or product development costs can't be tied to customer acquisition metrics, startups are left making decisions in the dark. This lack of visibility leads to inefficiencies, operational risks, and mounting costs. And when you add inefficient processes into the mix, decision-making slows down even further.

Slow and Manual Reporting Processes

Traditional reporting methods often leave startups stuck in a cycle of slow decision-making. Manual reporting relies on outdated data, which is far from ideal when businesses need to pivot quickly. Many companies still analyze performance on a monthly or quarterly basis, but in today’s fast-paced world, real-time insights are essential.

Even worse, manual processes eat up time that could be better spent on strategic decision-making. Instead of generating actionable insights, teams get bogged down in gathering and organizing data.

Take this example: a mid-market professional services company once spent 6 hours preparing reports. By switching to automated reporting with a centralized data platform and real-time dashboards, they cut that time down to under 20 minutes. Not only did they save time, but they also improved data quality and encouraged more frequent use of reports. This kind of transformation highlights just how costly and inefficient manual processes can be for startups.

Rigid Stakeholder Reporting

Different stakeholders need different insights, but standard reporting often falls short. Investors care about growth metrics and burn rates, board members focus on strategic KPIs, and internal teams need operational details. When startups rely on one-size-fits-all reports, they end up scrambling to create last-minute, incomplete analyses - especially during high-pressure situations like fundraising or board meetings.

This lack of flexibility also creates challenges within the company. Different departments often require specific metrics that generic reports don’t provide. Without the ability to quickly tailor reports to meet these diverse needs, internal communication suffers. Ultimately, rigid reporting systems make it harder to deliver timely insights and strategic guidance.

Missed Opportunities from Poor Visibility

When startups lack a clear view of their financial and operational performance, they risk missing both growth opportunities and cost-saving measures. For instance, they might continue to pour money into underperforming marketing channels, overlook profitable customer segments, or fail to identify areas where expenses could be reduced.

Cash flow management is another area where poor visibility can cause major problems. Delayed detection of budget overruns or missed chances to optimize spending can leave startups scrambling to course-correct. Founders often don’t spot these issues until it’s too late - after the damage is already done. Without real-time data to guide them, startups risk missing critical signals that could shape their strategy and future success.

How Multi-Dimensional Reporting Solves Startup Problems

Multi-dimensional reporting takes on the common challenges startups face by offering integrated, real-time data solutions with customizable insights. This approach helps startups move past fragmented systems and outdated processes, paving the way for smarter decisions and streamlined operations.

Unified and Real-Time Financial Data

One of the standout features of multi-dimensional reporting is its ability to unify financial and operational data into a single, centralized system. This consolidation provides a comprehensive overview of a business, equipping founders with the information they need to make smarter choices.

"Multidimensional analysis and reporting enable informed and decisive leadership, with 360° visibility and actionable insights into business financial and operations activity. It adds clarity and broad context, so leaders can intelligently navigate the business towards the future." - Pamela Pierce, Product Marketing Manager, Analytics and Data Warehouse, NetSuite

The secret to this system's effectiveness lies in real-time data integration. Modern platforms, such as ERP systems, capture transactions as they happen, offering immediate visibility into financial health. Another game-changing feature is the use of dimensions or tags to categorize data. These tags allow businesses to break down information by department, product line, customer segment, or other relevant drivers. For example, startups can pinpoint exactly how much they’re spending on customer acquisition versus product development.

Startups that have adopted these systems report faster month-end closings, freeing up time for strategic initiatives. For companies with limited resources, saving time on administrative tasks can make a huge difference. Additionally, this unified data approach lays the groundwork for leveraging AI to predict trends and address risks, offering even more tailored insights for stakeholders.

Customizable Reports for Different Stakeholders

Another major benefit of multi-dimensional reporting is the ability to create customized reports tailored to the needs of different stakeholders. Instead of relying on generic financial statements, startups can generate views that focus on the metrics that matter most to specific audiences.

For instance, as 54% of investors anticipate investment activity to rebound by the first half of 2025, timely and transparent reporting has become even more critical. Investors want to see metrics like growth rates, burn rates, and runway projections. Board members focus on broader strategic KPIs, while internal teams need operational insights to optimize daily performance.

Customizable reporting also saves time. Preparing for investor meetings or board presentations often involves pulling data from multiple sources at the last minute. With multi-dimensional tools, founders can quickly generate investor-ready reports, ensuring consistency and accuracy while eliminating the stress of manual data assembly. This streamlined approach not only improves efficiency but also enhances communication with stakeholders.

AI-Powered Insights and Forecasting

The latest multi-dimensional reporting platforms incorporate artificial intelligence to provide insights that go beyond human analysis. For startups in fast-paced industries, these AI tools can identify trends, uncover opportunities, and flag potential risks early - key advantages in competitive markets.

AI-driven systems can process vast amounts of data, analyzing everything from social media chatter to market conditions, to predict emerging product demands. By combining internal performance data with external factors like seasonal trends or competitive shifts, these platforms generate accurate financial forecasts that help startups plan budgets and investments more effectively.

The potential for AI in business is massive, with the AI market projected to exceed $826.70 billion by 2030. Startups that adopt these tools early are already benefiting from faster decision-making, smarter resource allocation, and the ability to adapt to market changes. For example, a fintech startup might use AI to develop credit scoring algorithms that assess loan risks more precisely than traditional methods.

Risk management is another area where AI shines. These systems can analyze risks tied to market volatility, compliance, and supply chain disruptions, giving startups the chance to address problems before they escalate. A logistics startup, for instance, could use AI for real-time vehicle tracking and route optimization, cutting costs and improving delivery efficiency.

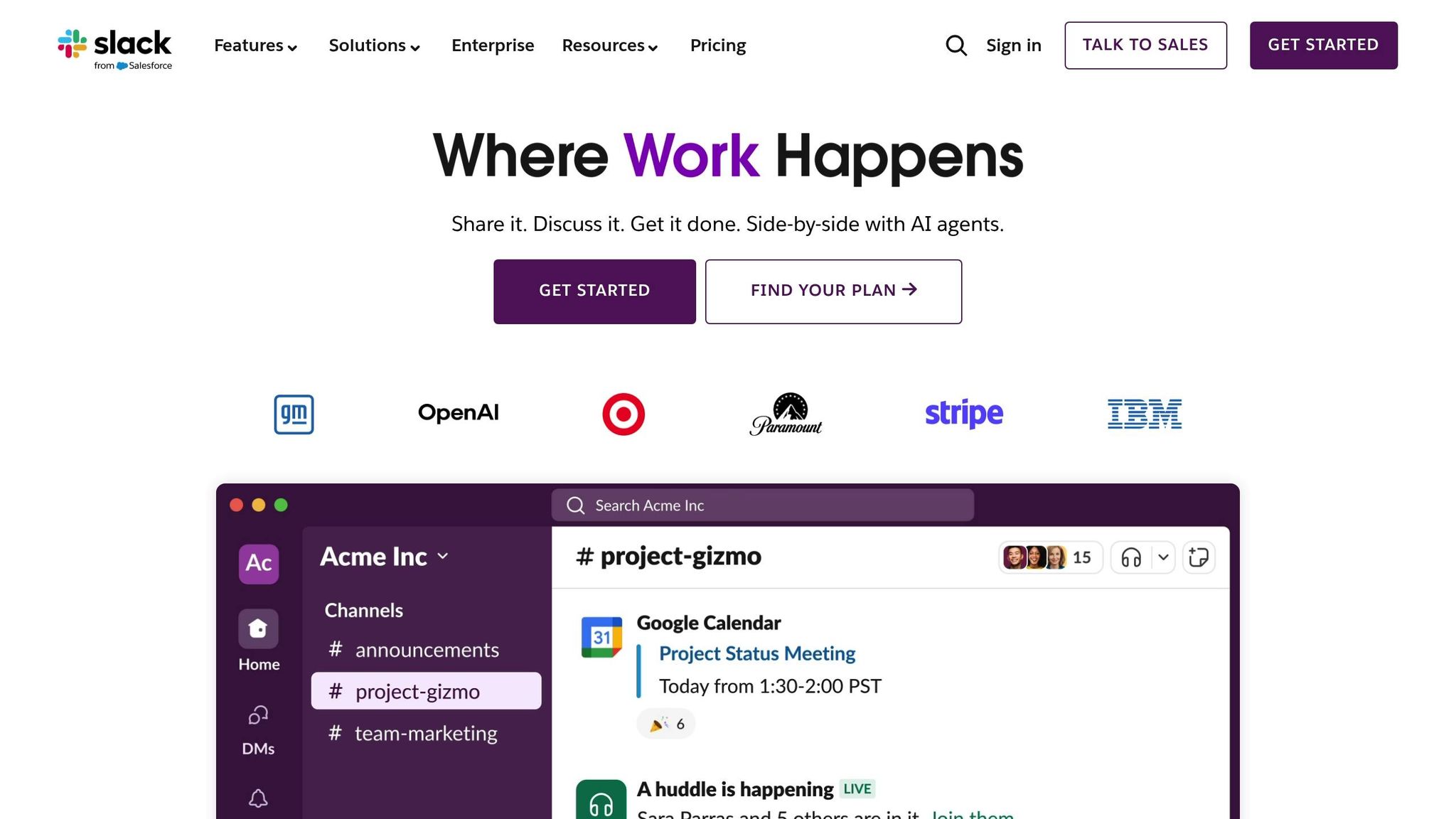

Platforms like Lucid Financials illustrate how AI and multi-dimensional reporting come together. This system generates forecasts, financial reports, and alerts in real-time, providing actionable insights that go beyond static data. With Slack integration, founders can ask questions about spending, runway, or performance metrics and receive instant, AI-backed answers. These tools, supported by human experts, ensure accuracy and compliance while empowering startups to stay ahead of challenges and seize new opportunities.

Setting Up Multi-Dimensional Reporting in Your Startup

To build a robust reporting framework, start by selecting a platform tailored for startups and ensure it integrates seamlessly into your daily operations.

Choosing a Startup-Focused Financial Platform

Pick a platform designed to handle both financial and operational data while offering automation and scalability. The right system should unify accounting, sales, CRM, inventory, and ecommerce into one centralized hub, solving the fragmented data challenges that many growing startups face.

A great example is Lucid Financials, which combines bookkeeping, tax services, tax credits, and CFO support into a single, intelligent platform. It promises clean books in just seven days and provides always-on, investor-ready reporting. This is especially valuable for startups that need to be fundraising-ready at all times.

When setting up your platform, use tags or codes to define multi-dimensional accounts. Structure your accounts so each number uniquely identifies a combination of dimensions, paired with clear descriptions like "Revenue-Enterprise-North America". This clarity ensures your financial data is easy to interpret and analyze.

Once your platform is operational, enhance its functionality by integrating real-time tools for better accessibility and decision-making.

Using Real-Time Slack Integration

Adding real-time integrations to your financial platform can transform the way your team interacts with financial data. Slack, for instance, is an excellent tool to centralize real-time insights, enabling instant access to metrics and automated alerts. Modern CFO teams rely on Slack integrations to streamline communication and make financial data more actionable.

By integrating Slack, you can bring reporting tools, processes, and team members into one workspace. Instead of navigating multiple dashboards or waiting for monthly updates, founders can simply ask questions - like current runway or spending trends - and get immediate answers. This integration enhances the multi-dimensional approach by providing instant insights that drive faster, smarter decisions.

Custom Slack dashboards can be configured to display critical metrics such as revenue, headcount, and live departmental budgets. Automated alerts can notify teams when, for example, marketing performance is lagging behind targets, along with actionable recommendations.

Lucid Financials takes this a step further by embedding AI-powered insights directly into Slack. Founders can ask complex questions about financial performance and receive intelligent, real-time responses. When deeper analysis is required, the finance team is accessible within the same interface, creating a seamless, time-saving experience.

Creating Investor-Ready Reports

Investor-ready financial reports are not just about accuracy - they also demonstrate your business's transparency, stability, and financial discipline. A well-designed multi-dimensional reporting system can automatically generate these reports, ensuring you're always prepared for investor meetings, board presentations, or due diligence.

These reports should include key financial documents like income statements, balance sheets, and cash flow statements, along with essential KPIs such as CAC, LTV, burn rate, runway, and revenue per employee . Multi-dimensional reporting allows for detailed analyses, such as breaking down revenue by customer segment, mapping expenses by department, or tracking growth trends across product lines - all in one comprehensive report.

"Your financials should tell a story of not just where your business is today, but how it's evolving - and why an investor should want to be part of that journey".

Presentation is equally important. Reports with professional formatting, clear charts, and logical flow inspire confidence in investors. Multi-dimensional platforms simplify this process, generating polished, ready-to-share reports with a single click - eliminating the delays caused by manual preparation.

To stay ahead, establish regular reporting schedules and review sessions. These rituals turn data into actionable insights, helping your team stay aligned on performance goals and respond quickly to any issues. This approach equips startups to make strategic, data-driven decisions effectively.

sbb-itb-17e8ec9

Conclusion: The Future of Financial Reporting for Startups

Multi-dimensional reporting is reshaping how startups manage their finances. As businesses grow more complex and data-driven, traditional financial reporting methods often fall short of meeting modern demands.

Key Points for Founders

For startup founders, the message is clear: 56% of companies state that data analytics enables faster and more effective decision-making. In the fast-paced, resource-limited world of startups, this speed can be the difference between capitalizing on opportunities or missing them altogether.

Multi-dimensional reporting transforms static data into dynamic, actionable insights. It allows you to evaluate your business growth across multiple dimensions in real time. This isn't just about better numbers on a page - it's about seeing your business from every angle, all at once.

The benefits go beyond the reports themselves. Multi-dimensional reporting fosters a culture where data drives every decision and process. For example:

- Marketing teams can track how customer acquisition costs vary by channel.

- Product teams can measure revenue generated by specific features.

- Operations teams can monitor departmental expenses, all updated in real time.

Perhaps most importantly, this approach equips startups with the agility to adapt in volatile markets. With immediate, detailed insights, you can identify problem areas and allocate resources effectively during market changes.

The Role of Platforms Like Lucid Financials

To bring these benefits to life, purpose-built platforms are essential. Platforms that combine AI with expert support are leading the way in modern financial management. Lucid Financials is a prime example, offering AI-powered tools that generate forecasts, financial reports, and alerts based on live data. This isn’t just about automating tasks - it’s about delivering real-time insights that empower confident, data-driven decisions.

Platforms like Lucid unify data and provide instant, actionable insights. For instance, Lucid’s Slack integration lets you ask complex financial questions and receive intelligent, instant responses, with human experts available for deeper dives when needed.

Lucid’s ability to create instant financial plans and scenario forecasts highlights where the industry is heading. Startups can quickly model different scenarios, compare outcomes, and adjust strategies in real time. This capability becomes especially critical during fundraising, when investors expect detailed financial models and transparent reporting.

As startups face increasing complexity and higher expectations from investors, those that adopt multi-dimensional reporting early will gain a competitive edge. The tools to transform how you manage and understand your business are already here - the question is, will you embrace them before your competitors do?

FAQs

How can multi-dimensional reporting help startups manage their cash flow more effectively?

How Multi-Dimensional Reporting Improves Cash Flow Management

Multi-dimensional reporting equips startups with real-time insights into their finances, making it easier to monitor and manage cash flow. By breaking down cash inflows and outflows across different angles - like projects, departments, or customers - it provides a detailed view of where the money is coming from and where it's going.

This granular approach helps founders spot patterns, create precise forecasts, and make smarter financial decisions. Whether it's reallocating funds to high-performing areas or preparing for unexpected hurdles, this tool ensures startups can manage their resources efficiently and stay ready for opportunities to grow.

How does multi-dimensional reporting differ from traditional reporting in analyzing data?

Traditional vs. Multi-Dimensional Reporting

Traditional reporting relies on static, historical data, typically presented in structured formats like financial statements. While these reports are great for summarizing past performance, they often fall short when it comes to providing the depth or flexibility needed for more detailed analysis.

In contrast, multi-dimensional reporting offers a dynamic and interactive way to explore data. It lets you analyze information from multiple angles, spot trends, and uncover real-time insights into complex relationships. This approach gives startups the tools they need to make quicker, well-informed decisions - essential for staying competitive and driving growth in fast-paced markets.

How does AI-driven multi-dimensional reporting help startups improve strategic planning and manage risks effectively?

How AI-Driven Multi-Dimensional Reporting Helps Startups

AI-powered multi-dimensional reporting gives startups a sharper view of their financial and operational data. By diving into patterns across various angles, it helps uncover potential risks, spot growth opportunities, and guide strategic decisions based on solid data.

This method equips founders with a real-time snapshot of their business performance, making it easier to manage risks proactively and plan more effectively. Tools like AI-powered reporting allow startups to focus on scaling their operations with confidence while staying ready to tackle challenges.